As the sports retail sector faces fierce competition, navigating economic uncertainties is crucial for success. According to McKinsey, only 6% of sportswear organizations felt confident in their resilience and performance amidst soaring inflation in 2022 and ongoing economic challenges in 2023.

Beyond economic factors, consumer buying habits are shifting, prompting questions about the primary channels for purchasing sportswear. Are customers turning to online aggregators like Amazon, sports retailers like Decathlon, or buying directly from the manufacturer’s website? Alternatively, are in-store purchases still significant, occurring in sports retailers or flagship stores of preferred brands?

In this dynamic landscape, marketing strategies have also evolved dramatically. The rise of Gen Z as the main consumer cohort has amplified the impact of influencers and technology. This makes social media and storytelling essential for effective customer engagement.

However, the true game-changer lies in data analytics. The power of data cannot be underestimated in the sports retailing industry. Retailers can leverage advanced data-driven analytics to predict customer behavior, personalize experiences, and enhance customer service. Understanding consumer needs and behaviors through data analysis has become a cornerstone of successful sports retailing in this fast-changing market.

In this article you’ll learn…

Which 5 Sportswear Retail Brands have been Selected?

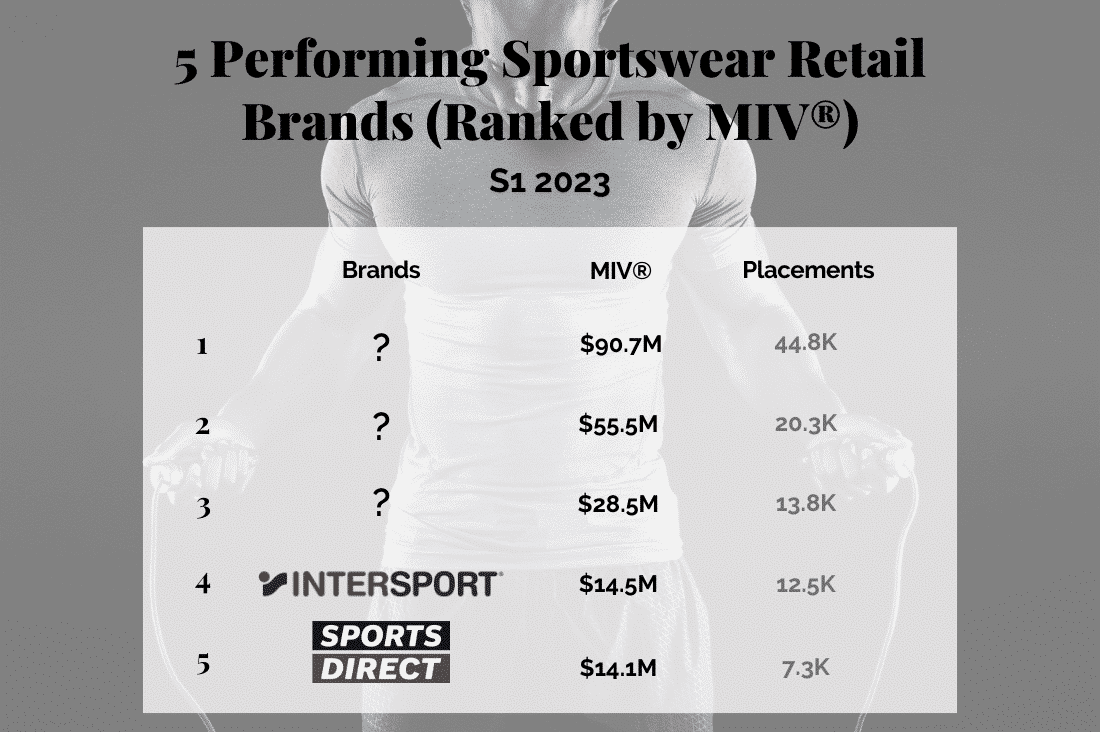

This insight provides a benchmarking analysis on five sportswear retailers in S1 2023. It uses our proprietary algorithm, Media Impact Value™ (MIV®), to measure and benchmark the impact of all media placements. Not to forget mentions across various voices during a selected period.

We analyzed the MIV® data in S1 2023, for the following five sportswear retail brands:

- Decathlon

- JD Sports

- Dick’s Sporting Goods

- Intersport

- Sports Direct

The infographic below displays the ranking of the five selected brands and the number of placements they had in S1 2023. These placements factor in social media posts and articles related to specific search queries, as well as consumer interactions with posts, such as tags and comments. It provides a clear picture of some brand’s performance in comparison to others in the industry, allowing you to identify opportunities for growth and maximize your impact.

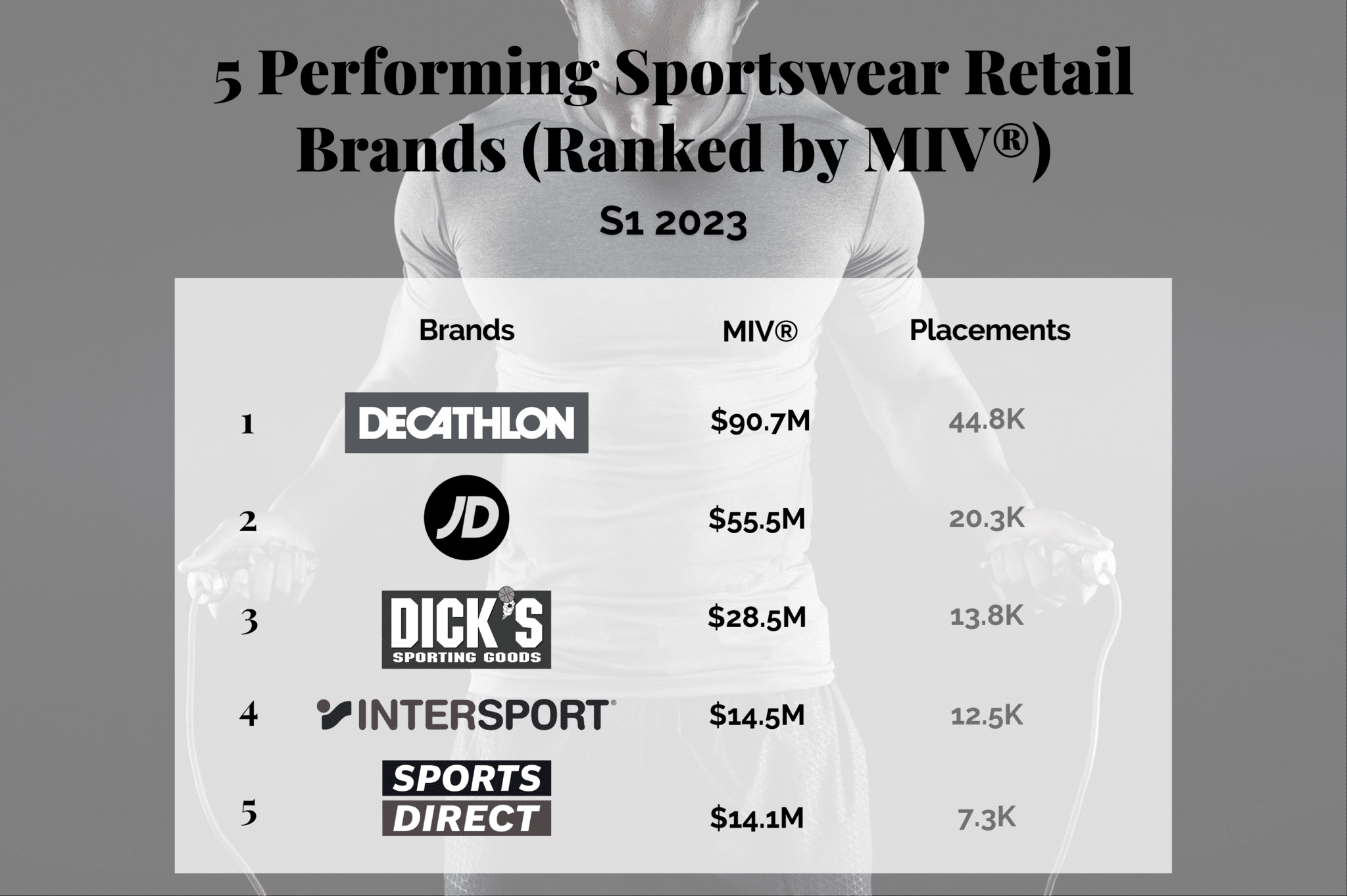

Voice Mix Benchmark for the Sportswear Retail Brands

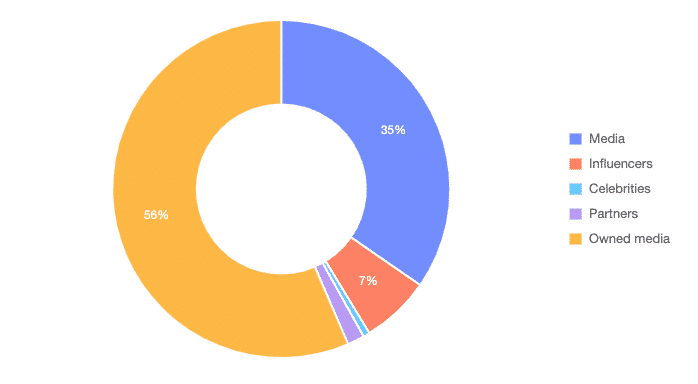

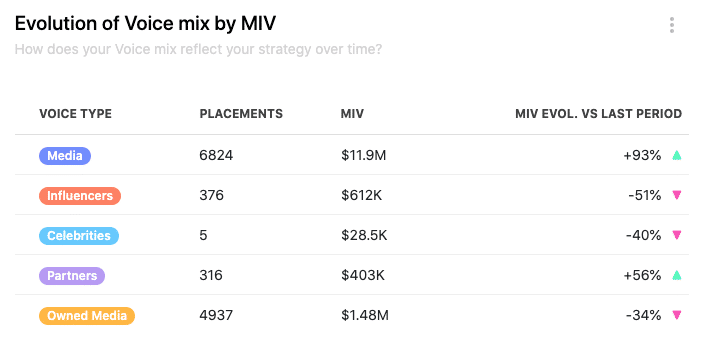

This infographic represents the Voice Mix Benchmark by MIV® for the five sportswear retailers in S1 2023.

The Voice Mix is a metric that provides the percentage of each of the five Voices that consumers are exposed to. They are: Media, Influencers, Celebrities, Partners, and Owned Media. The rate is based on the total MIV®, which each Voice generated for the retail brands. An awareness of this Voice Mix gives brands a better understanding of the best tactics to leverage for themselves.

Read on to find out more about the competitive benchmarking and analysis of the top five from the selected brands of this ranking.

Decathlon

Decathlon emerges as the best-performing sportswear retail brand in S1 2023. Renowned for its multinational presence, the brand achieved an impressive $90.7M in MIV® across 44.8K placements. This signifies a remarkable 21% increase compared to the previous semester, despite the economic downturn.

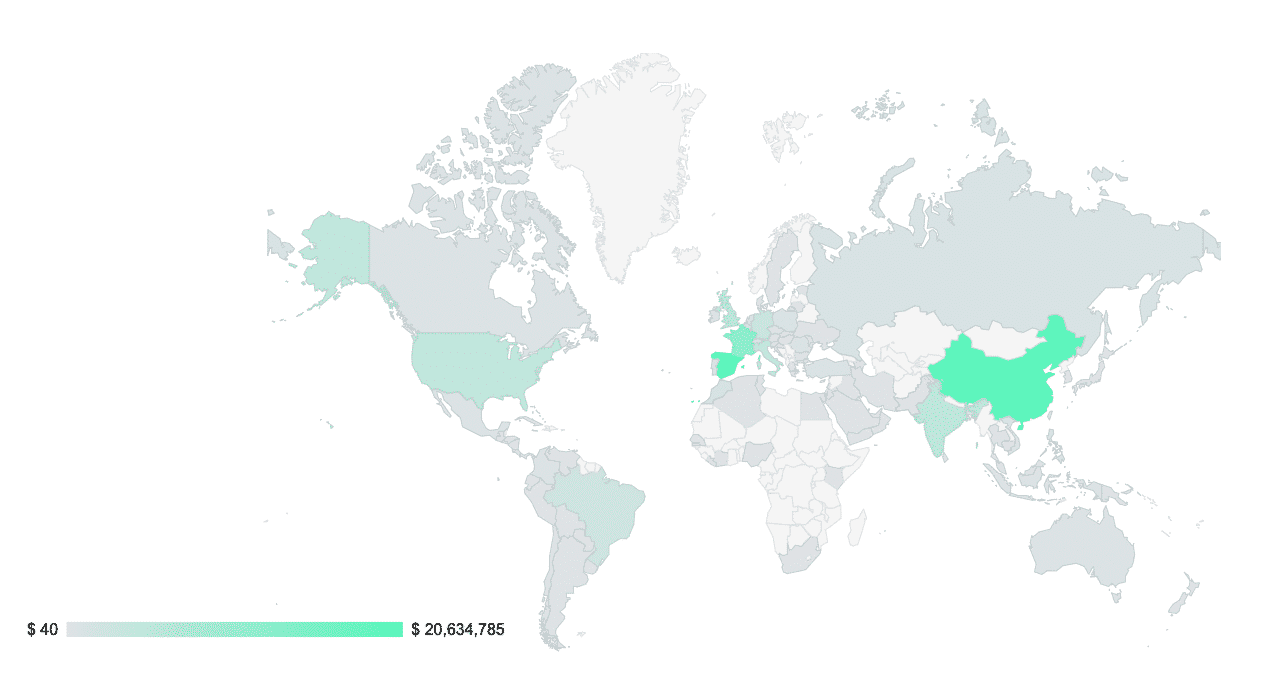

The brand’s success reached a global scale in S1 2023. Spain emerged as the most profitable market, surpassing even its home country, France, with a contribution of $20.6M in MIV®. These results were made possible by the widespread influence of prominent Spanish Media Voices. These included sources such as El Español, Trendencias, El Nacional, and many others. Following closely behind, the Chinese market proved to be another lucrative market. It generated $19.4M in MIV®. Furthermore, the French market still showed commendable performance with $12M in MIV®.

Analyzing the Voice distribution, Media dominated as the top Voice for Decathlon. The Voice generated $60M in MIV® across 30.6K placements, comprising 66% of the brand’s Voice mix. Owned Media secured the second position with $17.3M in MIV® across 10.9K placements, followed by Influencers with $12M in MIV® across 3.1K placements. Notably, all Voices demonstrated growth, with Owned Media experiencing an impressive 66% increase.

Examining the Channel Mix, Online emerged as the leading Channel for Decathlon, contributing $49.4M in MIV®. Douyin also played a significant role with $12.5M in MIV®, underscoring the brand’s success in the Chinese market.

The top placements, particularly on social media, captured considerable attention. The most impactful placement was by Celebrity Voice Avneet Kaur Official on Instagram, generating $590K in MIV®. The subsequent top placements were also on Instagram by Influencers, including Mohamad Adnan (224K in MIV®) and HugoDécrypte ($159K in MIV®). The fifth placement was by Owned Media Decathlon Bulgaria’s YouTube Channel, generating $157K in MIV®.

JD Sports

JD Sports, the second-ranked sportswear retail brand in our selection, has generated an impressive $55.5M in MIV® during S1 2023. This boasts a remarkable 22% growth since S2 2022. This exceptional feat is largely attributed to their success in the UK, where they generated a significant $26.4M in MIV®.

Taking a closer look at JD Sports’ Voice mix, Owned Media emerges as the dominant force, driving an influential $31.4M in MIV® across 8.1K placements—accounting for a substantial 57% of the brand’s overall MIV®. Media remains a stable source as well with $19.2M in MIV® across 10.9K placements. While Celebrities and Influencers played a more modest role, the strategic significance of activating influencers and celebrities cannot be overstated. Such collaborations wield the power to unlock enhanced brand visibility, bolster credibility, and access untapped audiences. Their influential recommendations and captivating content leave an indelible mark on sales, strengthening JD Sports’ image as an authoritative and reliable sportswear retail leader.

In the ever-evolving digital landscape, social media reigns supreme in JD Sport’s Channel mix, generating overall $38.9M in MIV®, with Facebook ($17.7M in MIV®) and Instagram ($15.7M in MIV®) significant to its success.

The essence of strategic activation comes to life through the standout Voice of Nita Shilimkar, whose two Instagram placements astutely contributed $814K in MIV®. Noteworthy influencers like Tobi Brown ($235K in MIV®), Lola Lolita ($199K in MIV®), and Jordan Nataé ($115K in MIV®) also wielded considerable influence, showcasing the game-changing potential of influencer activations. Leveraging these strategic alliances will continue to amplify brand coverage, engage discerning audiences, and propel JD Sports towards greater coverage.

Dick’s Sporting Goods

In the dynamic landscape of sports retail, Dick’s Sporting Goods emerged as a standout player, securing the third spot in our benchmark with an impressive MIV® of $28.5M in S1 2023. Notably, this performance is primarily driven by their dominant presence in the US market, contributing a remarkable $24M in MIV® alone.

Setting them apart from competitors is their strategic focus on high-profile Celebrity Collaborations, a powerful Voice that contributes a noteworthy $4.2M in MIV® across a mere 48 placements. Media, with its numerous placements, remains a strong pillar, generating an impressive $20.6M in MIV®, fueled by 11.9K placements. Additionally, Owned Media plays a significant role in the brand’s success, contributing $2.4M in MIV®.

As we delve into Channels, the online coverage is the most prominent with $17.1M in MIV®, largely due to the high-level Media Voice placements. Nevertheless, social media seems to be a key asset to the brand’s marketing strategies, with Instagram emerging as the most prevalent Channel, generating $5.8M in MIV®, followed by YouTube with $2M in MIV®, and Facebook with $1.4M in MIV®.

Harnessing the power of social media’s extensive user base, visual-centric approach, high engagement rates, and strategic use of Influencer and Celebrity Voices, particularly on Instagram, Dick’s Sporting Goods achieves remarkable success. The top eight placements for the brand are indeed on Instagram, posted by recognizable personalities in the sportswear industry. Leading the chase is the influential Dwayne Johnson, a crucial collaborator who accounts for eight of the brand’s top ten placements, contributing an astounding $3.4M in MIV® across nine placements. Joining him is Tom Brady, whose Instagram post garnered $238K in MIV®, and Allison Holker, who significantly contributed $185K in MIV® for Dick’s Sporting Goods.

Intersport

Intersport is another significant player in the sportswear retail market, generating $14.5M in MIV® in S1 2023. Showcasing a growth of almost 50% compared to the previous semester, Intersport has definitely improved its efforts in boosting its brand performance. The well-established sports retail brand’s most lucrative market was France. There, it generated $4M in MIV®, followed by Croatia with $3.3M in MIV® and $1.4M in MIV® in Germany.

In terms of Voices, Media is by far the most prominent with $12M in MIV® across 6.8K placements. This number is followed by the Owned Media efforts of the brand which accounted for $1.5M in MIV® across 4.9K placements. The other Voices weren’t as successful for Intersport this semester, but didn’t showcase as many placements either.

Leveraging all Voices creates a more versatile marketing strategy. It widens the brand’s reach, enhances credibility, fosters engagement, and diversifies platforms. By combining the strengths of various Voices, Intersport could achieve an even more balanced and cohesive marketing ecosystem, unlocking new opportunities, gaining valuable data insights, and ultimately driving even more brand performance and growth.

As a result of Media’s strong Voice presence, the main Channel for Intersport was actually Online with $10.9M in MIV® generated from the channel. Instagram followed with $1.5M in MIV®, not as much of a significant input in contrast to Online.

A prominent Partner-Voice has featured in Intersport’s key Voices and top placements. The Partner is none other than the Equipe de France de Football. Across five placements, the team has accumulated $303K in MIV® for Intersport and their top placement is also the top placement for the brand itself. Featuring Celebrity-Voices soccer players Antoine Griezman and Jules Kounde, the Instagram post is a perfect example of a cross-Voice placement, highlighting its effectiveness with $252K in MIV®.

Sports Direct

Sports Direct ranked fifth in our S1 2023 sportswear retail brand benchmark. It generated an impressive $14.1M in MIV® in S1 2023 alone – almost as much as Intersport. But with a 4% decrease in growth compared to the previous semester, Sports Direct is likely to kick its performance up a notch in S2.

In terms of market, Sports Direct is mostly local to the UK with an important $10.7M in MIV® attributed to its market. The US only generated $846K in MIV® for the brand, in sharp comparison.

Notably, Sports Direct’s Media Voice has been significantly prominent, generating approximately $11.1M in MIV® across 4.6K placements. That being said, the brand has not demonstrated as much effort, in terms of placement and therefore MIV®, regarding the other Voices such as Celebrities or Influencers, which could prove even more successful in the long run. After all, the brand’s collaboration with Influencers and Celebrities is sneakily proving its success in terms of the brands top placements.

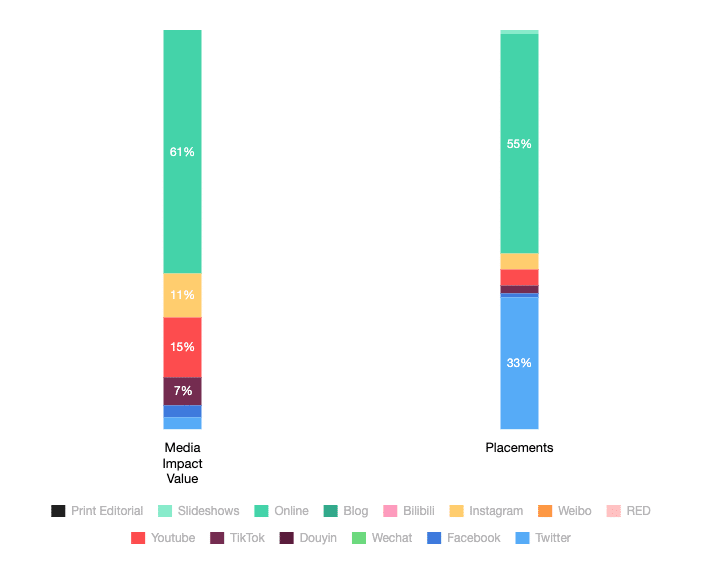

The brand’s Channel mix reveals that the Online Channel makes up 61% of the brand’s success, with $8.5M in MIV®. But, surprisingly, YouTube is actually the top-running social media platform for the brand, generating $2.2M in MIV®, followed by Instagram with $1.6M in MIV® and TikTok with $141K in MIV®.

As mentioned before, the top-performing placements for Sports Direct have mainly been by Celebrities and Influencers. Coming at the top, Cindy Kimberly’s Instagram post generated $295K in MIV®. In second place, Dom Short’s TikTok garnered $122K in MIV®. Amongst the other placements, significant names like The Destroyer, Phil, Rosie and Harry were also featured.

How to Benchmark your Sportswear Retail Brand

This insight aims to help you gain more awareness about successful marketing strategies. It also demonstrates tactics some of the best contemporary sportswear retail brands use to optimize their brand performance globally.

Do you want to learn more about your brand’s position? How it compares to your competitors? For that, you need a deeper dive into your brand’s performance analytics. Doing so, you can gain valuable insights into your campaigns’ effectiveness and identify areas for improvement.

If this insight has sparked your interest, start benchmarking your sportswear brand today by clicking on the link below.