The rise of digitally-native Direct-to-Consumer (DTC) brands, like Drunk Elephant & Glossier, has challenged the idea that retailers are necessary to build a successful brand. Social media platforms – along with the growing power of influencers – provide brands with a new way to connect to their target audiences and scale their businesses.

However, recent trends hint at a potential decline in the effectiveness of these tactics. Facebook has significantly limited the amount of consumer data available for ad-targeting purposes, due to privacy concerns. Couple this with the rising cost of ad-space and it can become tough to compete when you are a new beauty business. In fact, a recent Digiday article “estimates that for a $100 million business to get a return on Facebook, it would have to spend a minimum of $50,000 a month advertising on the platform.”

Additionally, Instagram engagement levels are now in decline, according to a recent report, pointing to an increasingly oversaturated market. In order to connect with today’s beauty buyers brands must incorporate new strategies and tactics into their marketing mix – starting with leveraging their retail partners.

So, how can retail partners help provide a more affordable way to reach consumers?

Hyper targeting new audiences

In the beauty industry, influencer campaigns and collaborations have been the most popular method for brands when it comes to reaching new audiences. However, finding the right influencer that matches your brand values can prove to be difficult when it comes to new targets.

Lately, beauty retailers have been investing heavily in their content marketing strategies, uploading beauty tutorials and creative content on their feeds that rival influencer campaigns. Ulta specifically, has generated over $3M in MIV® for the beauty brands they represent over the past six months including $800K for Tarte, $742K for Urban Decay, and $677K for Benefit, proving the value that retailers can bring to a beauty brand’s marketing strategy.

The added benefit of partnering with beauty retailers is that their follower base is highly targeted towards beauty fans. Their audience follows them specifically for beauty content, whereas followers of fashion and lifestyle influencers may be following their account for a multitude of different reasons, and may not be interested in beauty content.

Wider distribution & unlocking new markets

Retailers also have the benefit of being able to help brands activate new markets and regions if they are looking to expand their global reach. In 2015, Glossier – arguably the pioneer of DTC beauty brands – partnered with Net-A-Porter in order to expand the distribution of their Balm Dotcom skin salve in Europe. More recently, Lady Gaga announced that she would be partnering with digital mega-retailer, Amazon, for the launch of her new Haus Laboratories cosmetics line.

Global retailers like Amazon, tend to cast an extremely wide net when it comes to their distribution networks, making it easy for brands to reach new markets, whilst removing typical barriers to entry. Using partner retailers can also legitimize new brands in different markets, as they effectively get the stamp of approval from a trusted name like Amazon, Boots or Selfridges.

Amplify product launches

Finally, retailers can help amplify and generate excitement around new product launches. Sephora’s ‘regram’ of Huda Beauty’s Rose Collection lipsticks generated $337K in MIV for the brand, while their ‘regram’ of Pat McGrath’s new Lust Gloss shade Astral Moon Flower racked up $325K in MIV. In fact, over the past 6 months, Sephora has generated $34.3M MIV simply by “regramming” product launch posts from the brands that they carry. Repurposing content in this way is a great tool to boost awareness, generate hype and drive sales of new products. If retailers are not promoting your new products, consider making a formal agreement regarding the number and timing of posts for product drops to further optimize your beauty brand’s marketing strategy.

Negotiating exclusive product launches with retailers is another great way to capture attention while strengthening relationships with retailers. Take note from kitsch beauty brand Too Faced, who launched an exclusive Peaches & Cream collection at Sephora, generating over $265K in MIV. Collaborating with retail partners also strengthens your relationships with the brand as well as increasing awareness on their Owned Media channels.

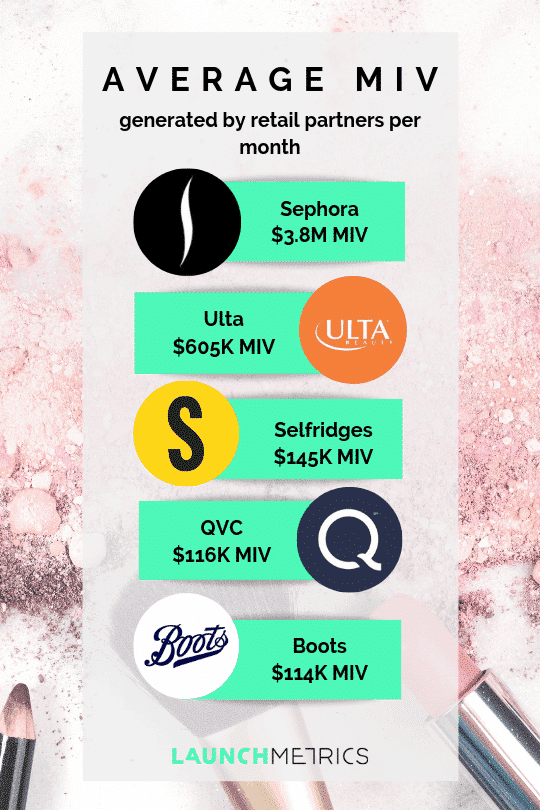

Retail partners continue to be a critical component of the marketing mix for beauty brands. On average, they drive 3% of the Voice Mix, which translates into significant value: over $47.5M MIV so far this year. Let’s take a look at the average MIV generated by Retail Partners for the brands they carry each month.

Average MIV Generated Per Month

How do your partnership marketing efforts compare to industry standards?

Click here to learn how you can up your beauty brand’s marketing strategy by calculating marketing contributions to brand value & benchmarking your performance against your top competitors’:

*MIV® is a registered mark in the European Union.