China represents 32% of global luxury consumption, according to Bruno Lannes of Bain & Company, and millennials have been at the forefront of this market growth. With data such as this being presented, it’s no wonder luxury brands are increasingly vying for the attention of Chinese consumers.

In our recently launched report, Understanding the Digital Luxury Consumer: Key Insights from East to West – in collaboration with China’s premier influencer marketing platform PARKLU – we were able to gain insights into the luxury market in North America, Europe and Greater China, brands’ strategies and consumer behavior. Below are some key conclusions, focused specifically on the Chinese consumer.

Chinese Consumers: What Luxury Brands Should Know

1. There’s nothing like a limited edition product.

In order to gain a holistic view on digital consumer behavior and the luxury market in China, we spoke to Xia Ding, President of International Fashion, JD.com and Head of TOPLIFE.

JD.com is a retail force to be reckoned with: not only is it China’s largest retailer with over $55 billion in revenue in 2017 and a year-on-year growth of over 40%, it’s also the 3rd largest internet company in the world (after Amazon and Alphabet). As far as it’s dedication to the luxury and fashion sectors, JD.com launched TOPLIFE last year, a platform which gives luxury brands more control of their interaction with customers online, and also offers specialized services such as white glove delivery. They also host pop-ups such as the one they carried out for Audemars Piguet last year, and work with brands to offer exclusive crossover collections.

Xia Ding

In the interview for our report, Ms. Xia reveals insights she’s gained from the success of the crossover collections: “…Chinese consumers are attracted to the idea of exclusivity – another key reason that the distinct nature of JD Fashion and TOPLIFE is so key to our model. The idea that collections are limited, and there are only limited amounts of an item available, sends a powerful message in the Chinese market and can help Western brands build up their image.”

This is just one of several great takeaways from our interview with Ms. Xia. Make sure to download Understanding the Digital Luxury Consumer to learn how JD.com is helping brands access consumers in China.

2. They really trust influencers (or “KOLs”).

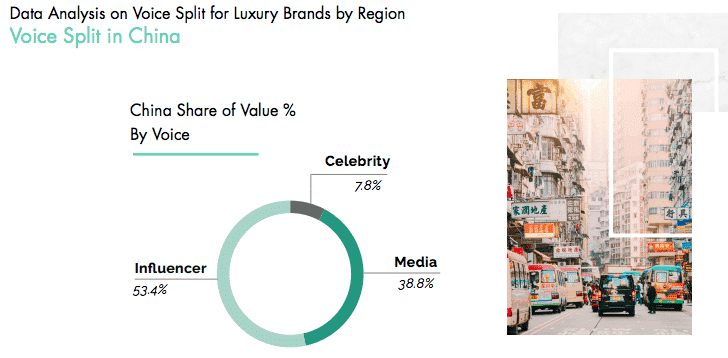

When analyzing digital impact, we use what is called the “Voice centric” approach, meaning we place emphasis on the Voices speaking in order to cross-compare performance. We identify 5 main voices: traditional media, celebrities, influencers, partners and owned media. This reflects the real investments and organizational decisions that surround marketing and communications strategy and allows brands to craft the perfect Voice Mix across various channels, media types and regions.

Thanks to our collaboration with PARKLU, we were able to take a look at the Voices driving impact in China and compare the analysis with our findings on Europe and North America. We found that Influencers – also known as Key Opinion Leaders (KOLs) in China – have even more impact in Greater China than in any other region. While influencers take 53.4% of the pie when it comes to Share of Voice, in Europe and North America they’re only at 21% and 34% respectively.

Needless to say, as a luxury brand entering China, collaborating with influencers is an absolute must in order to access Chinese consumers. To find out more, including the type of influencers that are most activated in this Asian country, be sure to download the report.

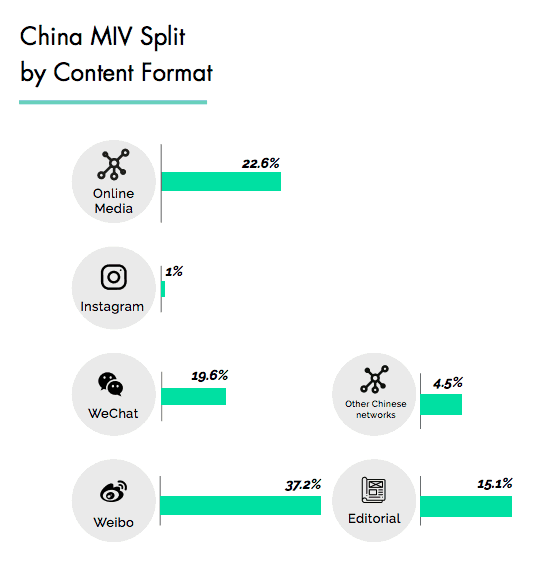

3. It’s all about Weibo and WeChat.

When it comes to China, you can forget about Instagram. As Chinese consumers have restricted access to Western platforms, they’re primarily active on native social channels – notably Weibo and WeChat. When it comes to content format, Weibo dominates with 37% in EMV, followed by online media at 22.6% and WeChat at 19.6%. However, brands take into account that creating content on Chinese social media platforms can be quite different from any other Western channel we’re used to.

We had the pleasure of speaking to Fashion Stylist, Consultant and former Senior Fashion Editor of ELLE China, Leaf Greener, who gave us some insights into the uniqueness of Chinese social media – particularly WeChat. According to Leaf, “WeChat is a very different platform…everything is different. Instagram is image based (whether through pictures or video) whereas on WeChat you can do so much more. You can write articles and design your own layout: it’s like a magazine!” And in fact, Leaf launched her eponymous digital magazine exclusively on WeChat in 2015.

Leaf Greener

These types of content possibilities are most certainly something to bear in mind for luxury brands when approaching influencers in China. Make sure to read Leaf’s full interview for her perspective on what brands should do to reach Chinese consumers, via this link.

4. Home-grown brands are capturing their attention.

Internationalization and the dawn of the digital era have allowed for consumers to get to know brands from all corners of the world. Louis Vuitton is one prime example of a luxury heritage brand that has successfully penetrated the Chinese market. According to LVMH’s 2017 annual report, “Asia-Pacific remained the region for the most brand revenue at 28%, with fashion and leather goods responsible for the highest percentage of sales.”

However, local Chinese brands are garnering buzz lately, as Leaf Greener revealed in our interview: “I’ve noticed in the past 10 years Chinese designers have become increasingly popular, because our economy is getting better and better. Also, a lot of Chinese designers who are based overseas are moving back. Most Chinese are very patriotic and that’s why I think for new Western brands, that means more competition.”

Leaf Greener

Jing Daily‘s Ruonan Zheng also expanded on this idea: “With a persisting cultural disconnect, international luxury brands still can’t fully satisfy Chinese consumers’ appetites. That leaves a real opportunity for domestic brands who can speak to their Chinese identity, and it needn’t come at the expense of growth in foreign markets.”

So, with Chinese consumers increasingly paying attention to local brands, how can Western luxury labels break into this market? Working with already established e-commerce platforms might help as Xia Ding, President of Fashion of JD.com, explained in our report.

5. Wallets are growing, and so is their luxury spend.

There’s vast opportunity for luxury brands looking to expand into the Chinese market. According to consulting firm, McKinsey, the number of luxury consumers will increase by 121% between 2016 and 2025 in China, compared to a 32% growth that will be seen in other markets around the world.

Bain & Company in their 2017 China Luxury Market Study also explains “New consumers, mostly Millennials have been major contributors to the market growth; Millennials are digital savvy and very knowledgeable about luxury. They like “fashion and casual,” favor designer brands and start buying luxury goods at a young age with relatively high frequency.”

Considering these stats on China’s booming luxury market, luxury brands must fine tune their strategies to take advantage of the opportunity. To gain more insights on how to access Chinese consumers, make sure to download our latest report: Understanding the Digital Luxury Consumer.