Chinese e-commerce live streaming platforms are on fire. On the evening of April 1st Viya sold a rocket – yes, a space rocket – on a Taobao Livestream, while Smartisan CEO Luo Yonghao hosted his first live stream e-commerce sale on Douyin. Luo’s three-hour Livestream racked up RMB 110 million in sales, with 900,000 orders, generating more than RMB 3.6 million in Yinlang, Douyin’s virtual currency. Over 48 million people watched the broadcast.

In this article you’ll learn…

Intro to Chinese e-commerce livestreaming platforms

Chinese e-commerce live streaming platforms had one of the few growth stories during the coronavirus pandemic. Many people still have an image of live streaming that is stuck in the early iterations of the form, which is based around a host simply talking to the camera and receiving virtual gifts. However, live streaming has moved far beyond those simpler times. Today, if you’re short on talent or quality content, there’s no place for you in the live streaming industry.

Taobao and Kuaishou are live streaming’s stalwarts, however, Douyin and Xiaohongshu are intensifying their focus on e-commerce live broadcasts. Weibo recently carried out a comprehensive upgrade of its e-commerce functionality, officially launching ‘Weibo Stores’ at the end of March. JD Live started pan-entertainment marketing.

So what are the differences between livestreaming on each of these platforms – Taobao, Kuaishou, Douyin, Xiaohongshu, Weibo, and JD.com? Which platform is the most powerful driver of sales? And how well-suited is each platform to different types of brands?

Taobao Live

In just two years, Taobao Live went from zero to RMB 100 billion in sales generation. During 2019’s Singles’ Day, daily transaction volume hit RMB 20 billion. More than ten livestreamers each broke the RMB 100 million sales barrier, and over 100 live streamers achieved sales of RMB 10 million.

Taobao Live is one of the biggest Chinese live-streaming platforms in every respect, whether in terms of the number of merchants or the overall user base. It’s currently the largest of Chinese e-commerce live streaming platforms, distinguished by its high mobile traffic and conversion rates.

Who’s watching?

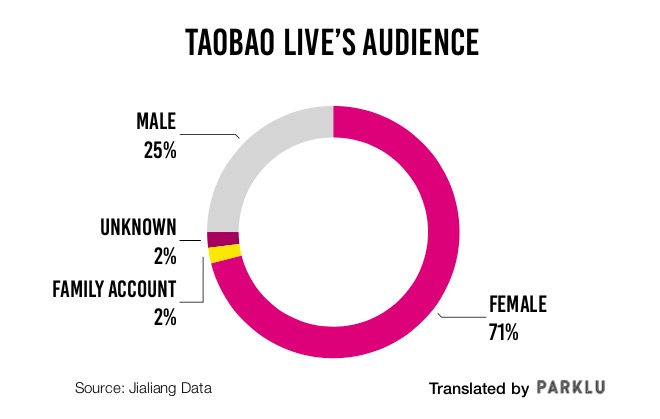

Taobao Live’s audience is 71 percent female, and 72 percent of overall users are between 18-34 years old. That means Taobao may not be the ideal platform for brands whose marketing is targeted more towards men or older consumers.

Popular sales categories

Taobao Live’s biggest e-commerce categories are clothing, followed by beauty, parenting goods, food, and jewelry. Sales on the platform are driven heavily by its Top-tier KOLs. Items tend to be priced between RMB 200-500, and return rates are high.

E-commerce entry points

Taobao

Kuaishou

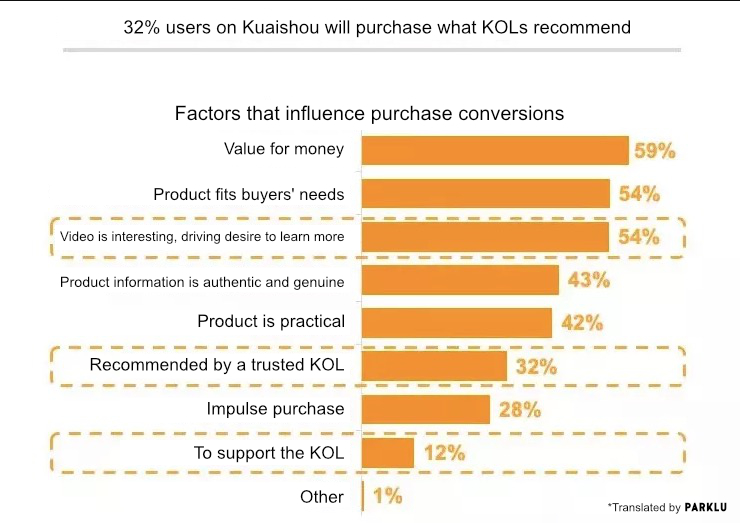

Kuaishou delivers on the metric that keeps marketers awake at night: conversion rate. Liu Yan sold RMB 10 million worth of goods in only three hours, and Guo Fucheng sold 160,000 bottles of shampoo in five seconds. Even a user with only 110,000 followers can top the live streaming sales charts.

Kuaishou launched live streaming in 2017. From the outset, the platform ran on two value propositions: rewards and sales. Although Kuaishou got into live streaming after Taobao, it grew extremely fast. The secret to Kuaishou’s rise has been a rough and ready approach: not letting perfection be the enemy of progress.

Who’s watching?

Taobao vendors address customers with the word “dear,” conveying a sense of closeness that can drive conversions. Kuaishou users use Lao tie (“old iron”) when referring to each other. The title is a sincere expression of unbreakable friendship that reflects the tight bonds that users form with content creators on the platform.

The ratio of male to female Kuaishou users is relatively balanced at 54 percent to 46 percent. Third and fourth-tier cities and below account for around 64 percent of all users. More than half of the platform’s users are between 25 and 50 years old.

Popular sales categories

Mainly low-margin, backstock products, with prices generally under RMB 300. Livestreamers and Key Opinion Leaders need to cultivate a relationship with the viewers – to become Lao tie – in order to make sales. Sales of personal care, cosmetics, clothing, food, and alcohol are the most popular.

E-commerce entry points

Kuaishou is one of the Chinese e-commerce live streaming platforms that has its own native e-commerce stores. Its e-commerce features can also be accessed through third-party platforms including Taobao, Tmall, JD.com, Pinduoduo, Youzan, and Mockuai.

Douyin

Douyin’s e-commerce live streaming platform comes nowhere near Kuaishou or Taobao Live, however, Douyin is growing fast. Short-video is its main driver of traffic and algorithm-powered curation makes sure the right viewers are watching. Douyin’s traffic approach creates tremendous potential for virality and high user “stickiness.”

Who’s watching?

Douyin boasts 400 million daily active users, making it the leader among short video platforms. A large number of these users are female, and women tend to be more likely to tune into e-commerce livestreams. Douyin users are largely concentrated in first- and second-tier cities. Featured products are subject to strict reviews, in addition to restrictions on sales of certain products. Livestreaming traffic is generally funneled through short-video content, which can play a part in helping to filter user demographics.

Popular sales categories

Brands should stick to daily necessities that are limited-edition and on sale, such as toothpaste, laundry detergent, etc. Beauty and clothing and other department store goods up to RMB 200 also tend to do well.

E-commerce entry points

In-platform entry points include the shopping cart, Douyin stores, and users’ profiles. Douyin also supports third-party platforms like Taobao, Tmall, JD.com, Kaola, Vipshop, and Suning.com.

Xiaohongshu

Xiaohongshu started beta testing e-commerce live streaming at the beginning of this year. Since kicking off, several live streams have proved promising for high conversion rates and high spend per customer, despite relatively low sales volume.

According to third-party data, the average livestreaming KOL has 7,500 followers and generates RMB 10,000 in sales. Compared to other Chinese e-commerce livestreaming platforms like Taobao, Xiaohongshu benefits from a stronger social network. Xiaohongshu’s livestreams are not simply a mobile version of a home shopping network like Taobao. Taobao is inherently an e-commerce platform, so its users are going there specifically to fulfill certain shopping needs and expectations. Xiaohongshu, on the other hand, serves an entirely different purpose for users (product reviews, lifestyle inspiration, etc.). As a result, its livestreaming content will be different. KOLs and brands should keep user intent in mind when developing a livestream show.

Who’s watching?

For now, Xiaohongshu does not give livestreamers public traffic—instead, fans see the KOL’s broadcast on their own page. A KOL’s success largely depends on their relationship with fans.

Popular sales categories

During the current beta testing phase, Xiaohongshu has largely used its own branded products. According to media reports, a number of Xiaohongshu’s live broadcasts thus far have all shown the same data: the number of viewers is low, but the conversion rate is extremely high, while the average retail price of goods sold reaches about RMB 800.

E-commerce entry points

Xiaohongshu

Weibo recently upgraded its e-commerce capabilities and officially launched Weibo stores. Weibo stores provide brands with a range of e-commerce management services and e-commerce live streaming promotions. There’s no minimum threshold to prevent users from immediately hosting live streams. Weibo also offers free training to help live streamers sharpen their salesmanship.

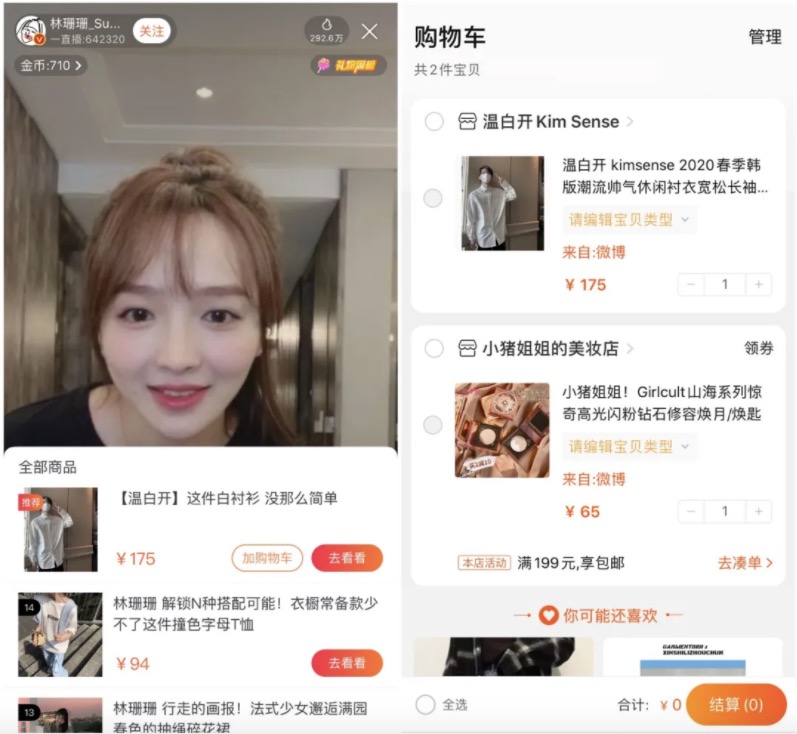

Although Weibo offers a “content-fan-user-monetization” model, e-commerce is still the main monetization avenue for Weibo KOLs and content creators. Last year, Weibo released an e-commerce service platform linked to Taobao. Verified users can also pay a subscription to access a Livestream account with better features.

Who’s watching?

Netizens turn to Weibo to interact with their favorite celebrities. The gender distribution on Weibo is about equal; males make up about 50.3 percent of users and females make up about 49.7 percent. Their top five cities are Guangdong, Jiangsu, Zhejiang, Beijing, and Shandong.

Popular sales categories

Clothing, daily necessities, shoes, and cosmetics.

E-commerce entry points

Taobao

JD Live

Most Chinese e-commerce live streaming platforms experience a spurt of growth before falling out of favor. Platforms should be continuously innovating and expanding upon their live stream experience to meet their users’ needs. JD.com does this with the launch of its new “Expert + Celebrity + Host” format, which integrates rich content with expert knowledge and a link to purchase, educating viewers about a brand while also giving them the confidence to buy a quality item on the spot.

Who’s watching?

JD.com uses a “hexagonal ecosystem” of pan-entertainment marketing. This approach subdivides users into groups of fans as well as mass users. The platform not only provides brands with a marketing channel but also provides fans with a support network. JD Live uses these methods to create a new model of e-commerce live streaming in the field of pan-entertainment marketing.

Popular sales categories

JD Live, across all categories, is generally reliant on a strategy of building up KOLs to be super celebrities and using that model to promote premium products. Return rates are high.

E-commerce entry points

Jingdong

Generally speaking, the pricing model for each of these Chinese e-commerce live streaming platforms is a base fee plus commission, which is generally 10-20 percent.