Welcome to our new five-part blog series, where we focus on the different Voices influencing customer journeys. In this first installment, we will be focusing on the value that an Owned Media strategy can bring to a brand, through the example of the haircare industry, using a comparative case study of two household names, Kérastase and Redken – both part of the L’Oréal group.

One of the most important things to consider when planning your Owned Media strategy is brand efficiency. Brand efficiency represents the average Media Impact Value™ a brand earns per post or placement, indicating how efficient a specific marketing tactic is.

If a brand has garnered $10M in Media Impact Value™ across 10 placements during the month of January, their average MIV® per placement would be $100K – This figure is representative of their brand efficiency.

If a brand has garnered $10M in Media Impact Value™ across 10 placements during the month of January, their average MIV® per placement would be $100K – This figure is representative of their brand efficiency.

Brand efficiency is relevant no matter the industry or vertical. Haircare, for example, is a part of the beauty industry that according to Statista, has been estimated to be worth $105 billion by 2025. And, with the continuous emergence of ‘Instagrammable’ brands, it’s becoming increasingly challenging for established names to compete. Owned Media is, therefore, more crucial than ever for brands to successfully establish a direct-to-consumer business model to retain customer trust and loyalty.

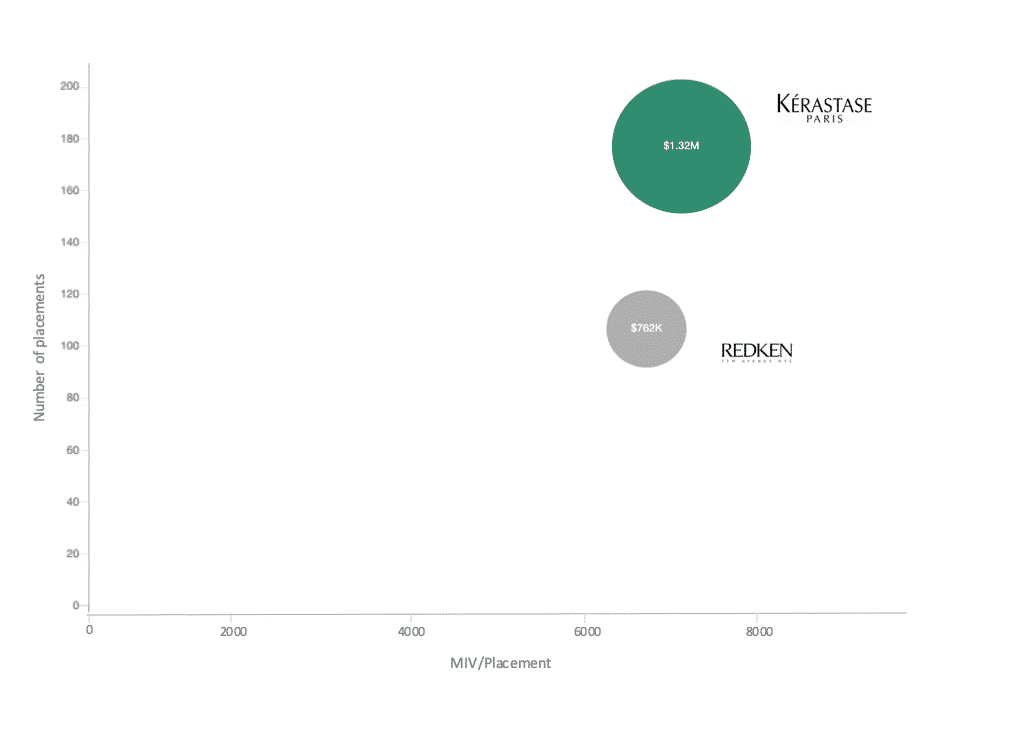

Brand Efficiency Relies on Quality Over Quantity

When it comes to Owned Media – Quantity is key, but quality is golden. For example, during the months of January and February, Redken generated a total of $762K in Media Impact Value™ across 108 placements. Although Kérastase almost doubled that, accumulating $1.32M in MIV® across 182 placements, when breaking down their average MIV® per placement, this figure was more or less the same for both brands – $7.06K and $7.25K respectively. If Redken had created the same amount of posts as Kérastase in this time period, their overall MIV® would, therefore, be roughly the same. The ultimate goal when it comes to all marketing activities is to gain the highest potential ROI, by utilizing your departmental budget in a more streamlined, data-driven way, allowing your team to save time and effort.

Consider Your Channel Mix

We have seen YouTube become a star channel within the beauty industry and with the rise of new social platforms such as TikTok, it’s important for brands not to neglect other channels that may seemingly be less popular – such as Facebook. This channel is particularly important for a haircare brand such as Kérastase who has been in the industry for more than 100 years as it has built up a loyal customer base. Kérastase has understood the importance of Facebook and the value the platform can bring for the brand and therefore invested almost 50% of the content executed during the first two months of the year to this channel – in return bringing a total of $938K of the MIV® – 71% of the total Share of Value.

Posted by Kérastase on Monday, February 3, 2020

By contrast, Redken heavily focuses on executing content on Instagram with 95% of their Share of Value coming from this channel alone. Their strategy for Instagram is mainly focused on educating their consumers and ensuring they produce ‘realistic’ content via tutorials. The brand showcases the effects and results of their products as well as sharing different tips, tricks, and inspiration from the perspective of industry professionals and influencers using Redken products. The brand’s top-performing post was part of their ‘TechniqueTuesday’ campaign, where a professional hairstylist educates their followers on the difference between babylights and micro slices. This marketing tactic is particularly successful in the haircare industry as it helps build trust from consumers as they become more and more conscious of the products that are absorbed into the hair and scalp.

Reaching New and Existing Markets

For heritage companies, regional accounts enable these brands to have the ability to reach out to new and existing audiences in different markets. Kérastase, for example, has been able to reach target audiences in South America and Spain by developing channels specifically for countries within those regions and tailoring content to fit their consumers. Around 50% of the total MIV® from the brand’s Facebook came from their 4 regional accounts in France, Brazil, Spain, and Colombia. Although Kérastase Worldwide garnered the highest MIV® (in terms of branded accounts) when looking at the accounts’ MIV® per placement, interestingly enough, Brazil, France, and Colombia had an average MIV® per post of $11K through fewer placements. The brand’s main account gained $6.7K in MIV® per post, exemplifying the value of tailoring your marketing strategy in line with differentiated consumers.

In a digital-era filled with influencer content and celebrity collaborations, it’s essential for brands to not underestimate the power of other key Voices that can bring more or just as much value, without compromising marketing budgets on costly initiatives. In “Behind Beauty”, released at the end of 2019, we concluded that although a lot of a brand’s marketing investment was attributed to the Celebrity and Influencer Voices, it was in fact Owned Media that held a larger share of ROI. If you are planning your Owned Media strategy, download this checklist to understand the different steps to consider when leveraging this Voice.