Since the launch of our Business of Beauty report – in which our experts analyzed over 700 brands – we’ve been deep diving into the beauty space to pick out the top performing players of S1, 2022.

Today, we’re shining our spotlight on the skincare industry. We’re getting into the pores of the trends, product launches and most successful campaigns.

Skincare and ethical beauty: a clean palette

In recent years, consumers have become more ethics-led in their buying decisions. This is especially true for Gen-Z audiences. We’ve seen a rise in the need for clean and sustainable beauty products, with more transparency needed over ingredients. Consumers are more nuanced in their research.

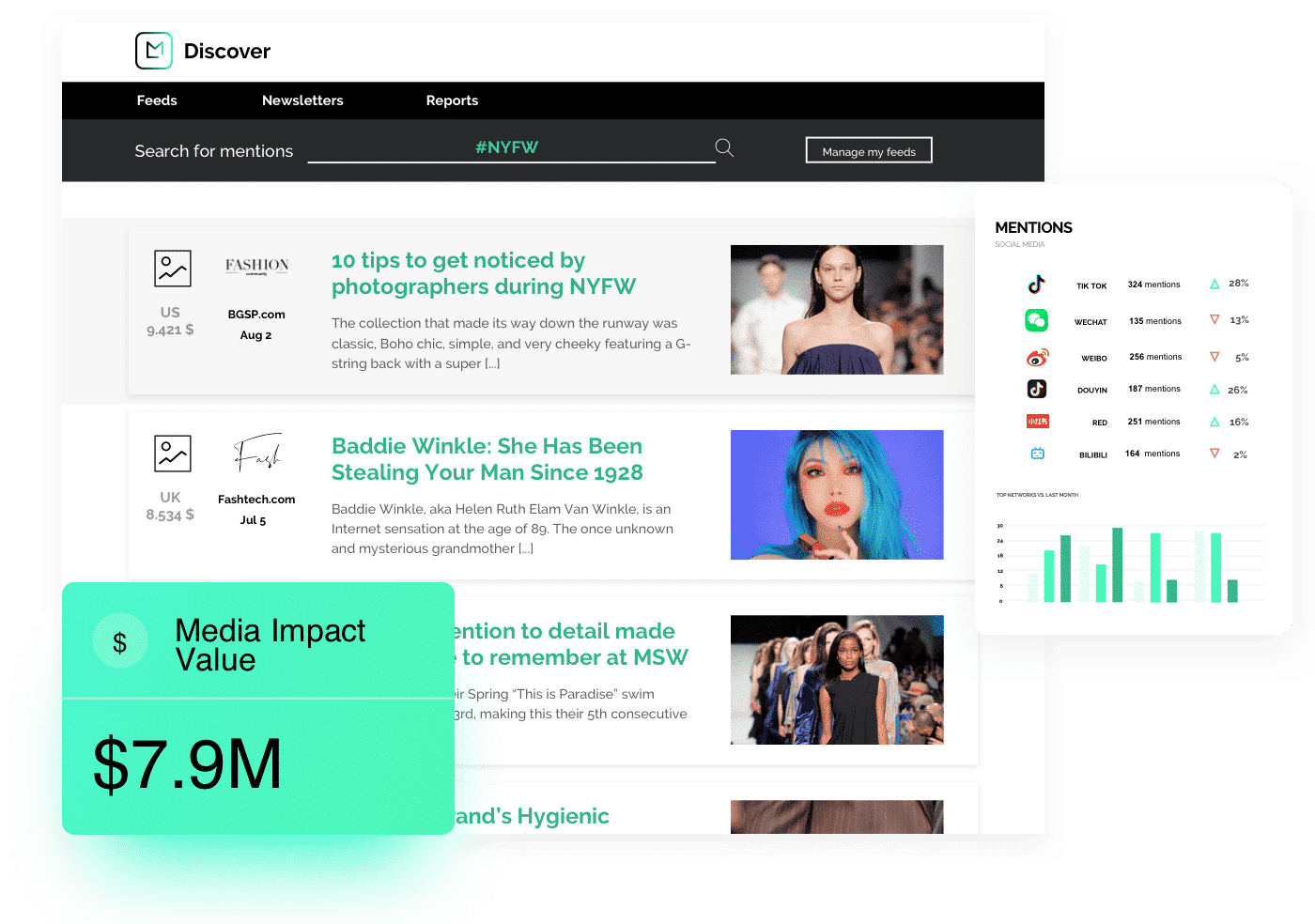

To address this new buying behavior, S1 campaigns ramped up a blending of makeup and skincare products. Some brands found themselves venturing into the world of blended makeup/skincare for the first time. It’s a move that has left many rewarded with increased brand exposure and a boost in Media Impact Value™ (MIV®).

With MIV® in mind, let’s start by taking a look at how skincare brands fared in S1 of 2022.

Top 10 Skincare brands by MIV®

Within the top ten list we see many usual suspects. Lancôme topped the charts, generating over $145m in MIV®. Within the L’Oréal Group portfolio, L’Oréal Paris and La Roche Posay (the only mass price-point brands to feature) came in second and ninth place.

L’Oréal Paris has clearly been working on its global marketing strategy. The brand saw huge success in China, with Douyin becoming one of its most lucrative platforms.

Brands with strong skincare hero products such as Estée Lauder, Shiseido and Clarins also ranked within our top ten. SK-II came in tenth position with over $71m in MIV® and a strong performance in media.

As always, brands utilized the power of social media platforms to market products. But what good are these platforms without a tool that monitors reach or return on investment?

Our tools were able to decipher the ten skincare-related posts that acquired the highest MIV®.

Top 10 Skincare posts by MIV®

Lancôme was the number one beauty brand by total MIV® within skincare. Yet it wasn’t mentioned within the top 10 individual placements by MIV®.

Posts that drove the biggest engagement within the skincare category were celebrity-driven. Six of these posts involved collaborations with celebs such as Millie Bobby Brown, HoYeon Jung and Ariana Grande.

But the top performers utilized the response of the market, promoting makeup and skincare hybrid products that blend the best of both worlds. It’s no surprise that makeup mogul Kylie Jenner took first, third and fourth place for highest earning MIV®. The influencer and reality star’s Kylie Cosmetics and Kylie Skin lines showcased her nourishing, tinted lip oils that feed the need for makeup/skincare fusion.

Outside of product promotion, brands saw impressive results with tutorial content that demonstrated the benefits of blended products.

Lâncome: a successful skincare strategy

If you read our first blog in this series, Top 10 Makeup Brands, Ranked by MIV® (S1 ’22), you’ll have found that Kylie and Dior dominated across both categories.

However, our skincare research has revealed a more diverse set of brands including Chanel, Florence by Mills, Fenty Beauty and REM beauty. It goes to show that, with the right strategy and competitor analysis tools, it’s all to play for in the world of skincare.

Now that we’ve covered some of the top brands and posts, let’s unpack Lâncome’s strategy to discover how the brand achieved global MIV® success.

Lâncome: Share of Voices by MIV®

Lâncome: Share of Channel by MIV®

Understanding Voice and Channel analysis makes up two key components that are essential for any successful brand campaign strategy. Lancôme leveraged the power of both.

Yes, Lancôme was the number one brand with the highest skincare-specific MIV® in S1 2022. The brand accumulated over $145m in MIV® and, as you can see from our breakdown, the majority of this success was driven by influencers and the media.

Lâncome: Top 5 posts by MIV®

What sets Lancôme apart is its strong presence across Chinese social media platforms. Typically, Instagram tends to be the leading source of MIV® for many beauty brands.

For Lancôme, the brand’s highest performance came through Chinese social platforms RED, Weibo and Douyin. In fact, these platforms accounted for more than 50% of the brands total MIV®.

Thinking of making an impact in China? You can find out more about the power of China marketing and Chinese social platforms in our blog, ‘Douyin: How Much MIV® ($) Could One Mention Offer a Beauty Brand?’.

Campaign success and the power of data

Having access to such granular campaign performance data can allow FLB brands to analyze what is and isn’t working for their campaigns on a global scale.

Not only does it inform better future decision making, it also allows you to benchmark your success against your competitors. You can even review the response to any celebrity collaborations or Influencer/Key Opinion Leader partnerships.

While a range of beauty and skincare brands have made millions in MIV® in the first half of 2022, we’re excited for our solutions to show us where the data takes us in H2.

Stay tuned for the final edition of our three-part blog series and don’t forget you can access our exclusive Business of Beauty report free today.