Do you know the position of your outdoor fashion brand in the market? Where does your brand stand in comparison to other brands? Do you have the necessary data to enlighten you on your competitors’ tactics and strategies?

In this mini blog series, we’ve portrayed the rankings of selected brands from various segments: sportswear, high-street, and premium fashion, among others. Now, as the weather drops to colder temperatures and people cozy up for the holiday season, it’s one of the perfect times to observe the performance of outdoor fashion brands. After all, to make the most of the season, knowing where your brand stands in this competitive market is pivotal. Start taking better PR and marketing initiatives supported by reliable data analytics that can help you benchmark your brand and your competitors.

In this article you’ll learn…

About Outdoor Fashion

Outdoor fashion brands have always had to go beyond high fashion trends and tendencies and include practicality and durability functions. A relatively discrete category of fashion in the past when it comes to media coverage, outerwear has since taken its rightful place in the spotlight. The brands now present their collections on runway shows and make unexpected collaborations with prestige brands.

To give you an overview of the current landscape, we benchmarked the performance of ten brands in the outdoor fashion sector. Thanks to our proprietary algorithm, Media Impact Value™ (MIV®), we could measure and benchmark the impact of all media placements and mentions across different Voices during a selected period.

What are the 10 Outdoor Fashion Brands we Selected?

For this competitive benchmarking report, we analyzed the MIV® data in October 2022, for the following ten outdoor fashion brands:

- Moncler

- The North Face

- Ugg

- Patagonia

- Barbour

- Canada Goose

- Stone Island

- Moose Knuckles

- Woolrich

- Columbia Sportswear

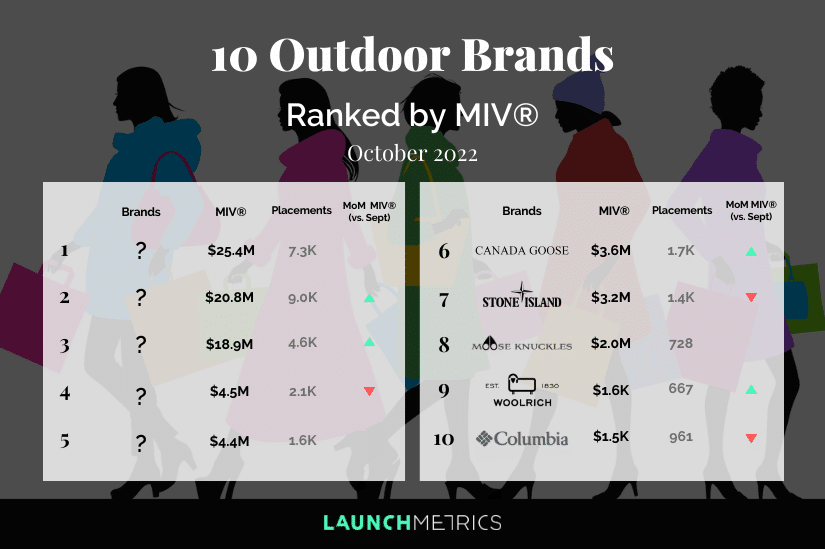

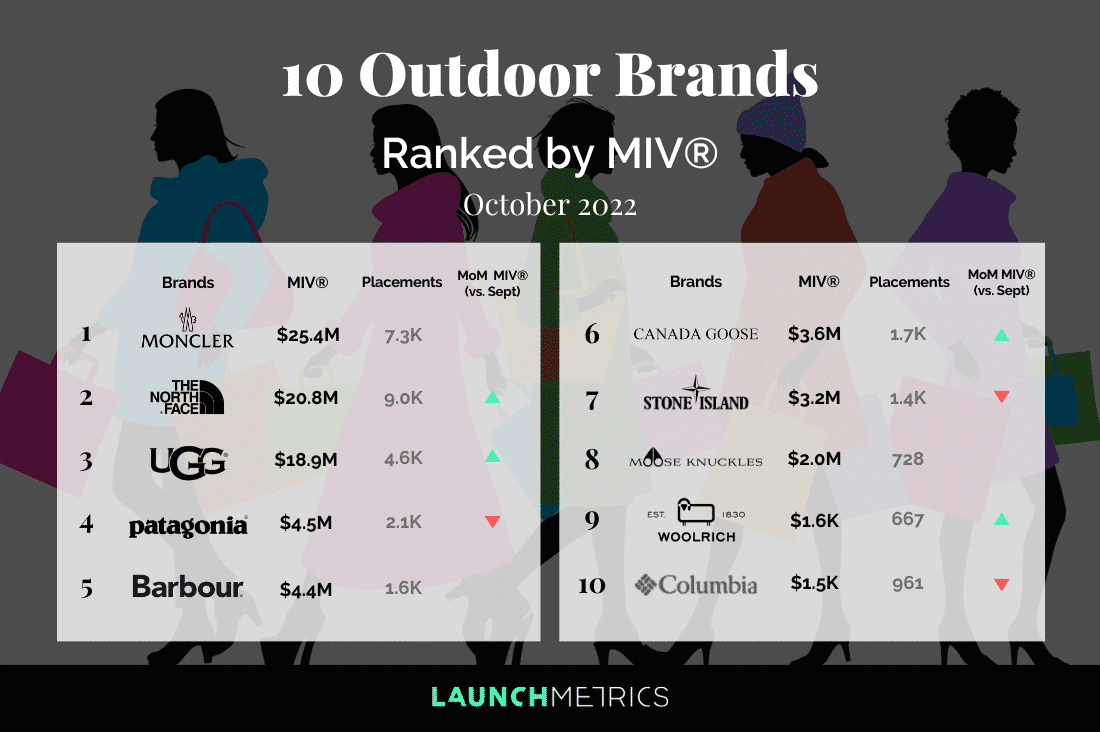

The infographic below displays the rankings of the selected outdoor fashion brands by MIV® in October 2022. It also displays the number of placements each of the ten brands had within the time frame. These placements factor in social media posts, articles pertaining to specific search queries. Additionally, it takes into account interactions consumers made with the posts such as tags and comments. Lastly, it illustrates the growth of the brand in comparison to the previous month.

Voice Mix Benchmark for the Outdoor Fashion Brands

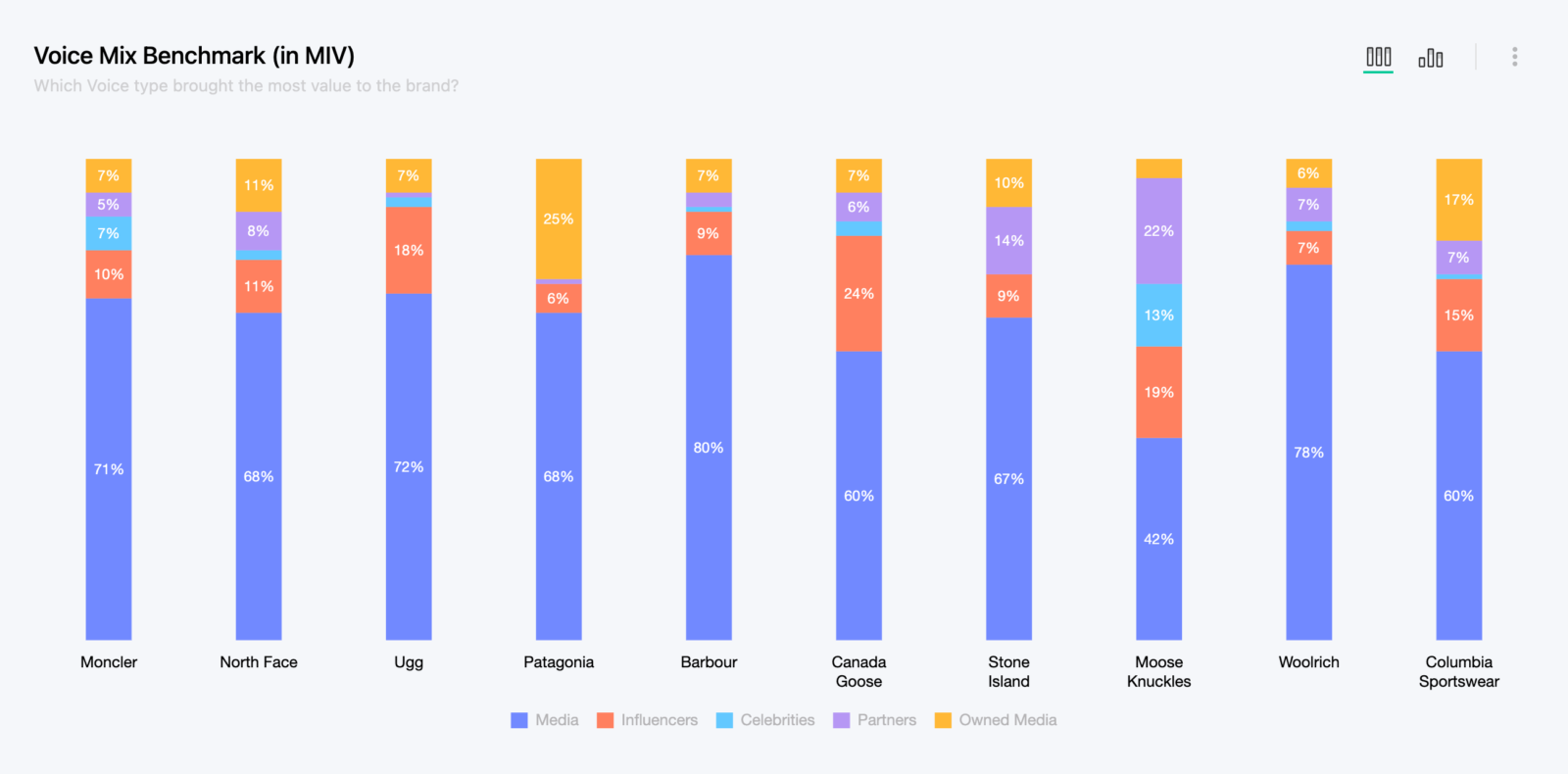

This infographic represents the Voice Mix Benchmark by MIV® for the ten outdoor fashion brands.

The Voice Mix is a metric that provides the percentage of each of the five Voices that consumers are exposed to Media, Influencers, Celebrities, Partners, and Owned Media. The rate is based on the total MIV®, which each Voice generated for the outdoor fashion brands. An awareness of this Voice Mix gives brands a better strategic understanding of the best tactics for themselves or their competitors.

This insight will be observing the singularities of the first five brands and what strategies have enabled them to generate more MIV®. So, what placements in each Voice found themselves most engaging to the consumer audience? Were there any successful cross-Voice or cross-Channel strategies your brand could also implement? Why are Moncler, The North Face, Ugg, Patagonia, and Barbour at the forefront of the rankings in terms of MIV®?

Read on to find out more about the competitive benchmarking and analysis of some of these ten outdoor fashion brands.

Moncler

Triumphing over the other selected brands for this ranking, Moncler generated $26.2M in MIV® in October 2022 across 7.4K placements. One of their strengths is their successful cross-Market strategy reflected by their worldwide reach. In terms of MIV®, it garnered $5.0M in the Americas, $9.3M in the APAC region, and $11.8M in the EMEA region.

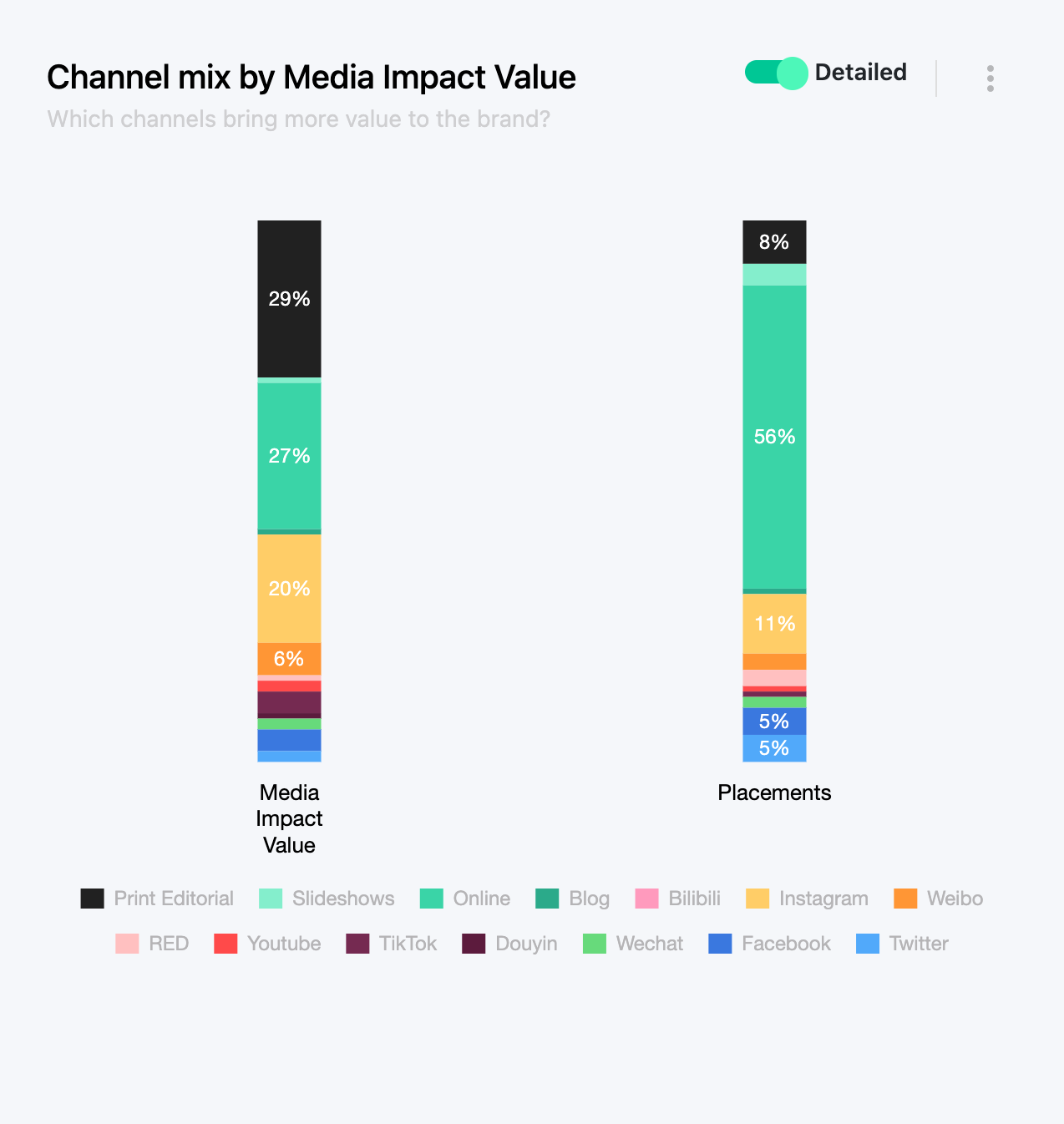

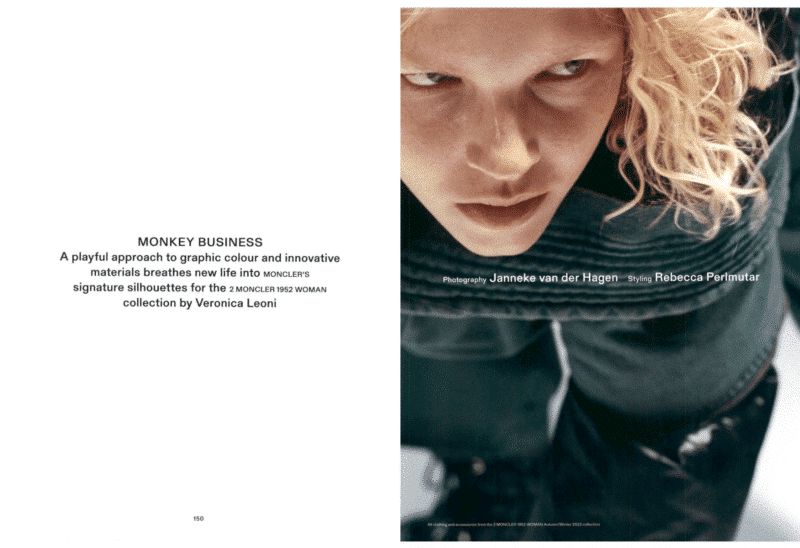

We can see a breakthrough in the Print Channel on the Channel Mix. All-encompassing, we’ve noticed an overall decline in the success of print editorial, but Moncler reveals the opposite. Print Editorial makes up 29% of the overall MIV®; this percentage represents $7.7M in MIV®. Among the top placements, the print editorial below from AnOther Magazine garnered $326K in MIV®.

Moncler’s success also stems from Instagram coverage. The top three placements across all Voices and Channels for the brand are on Instagram, illustrating the value of leveraging the platform. At the top of these placements, the post shown above by the K-pop Celebrity Hwang Min-hyun, garnered $381K in MIV®. This is another good demonstration of how Moncler’s success derives from its brand awareness worldwide.

The North Face

In second place in this outdoor fashion ranking is The North Face. The brand collected a total of $21.2M in MIV® across 9.3K placements. The Media Voice amassed $14.2M in MIV®, more than half of the brand’s overall MIV® generated. However, looking at the performance of the top placements, Owned Media proves to have been more prominent.

Reaching consumers today has become more complex than ever. Still, The North Face’s second iteration of the “It’s More Than a Jacket” campaign has proved that authenticity still hits the mark. The Youtube video for the campaign posted on October 4th, which garnered $364K in MIV®, is the top placement for the brand. With GRAMMY award-nominated artist Japanese Breakfast’s song in the video, this placement is a triumphant rendition of a cross-Voice Influencer and Owned Media strategy.

Ugg

Ugg displayed a remarkable 85% growth from October compared to September, with $18.9M in MIV® across 4.6K placements. Most of their success can be attributed to their use of the Media Voice, which pitched in $13.6M in MIV®. However, Ugg’s Celebrity and Influencer Voice-centered strategies have shown a lot of value, especially in the APAC region with the prominent influence of Key Opinion Leaders (KOLs).

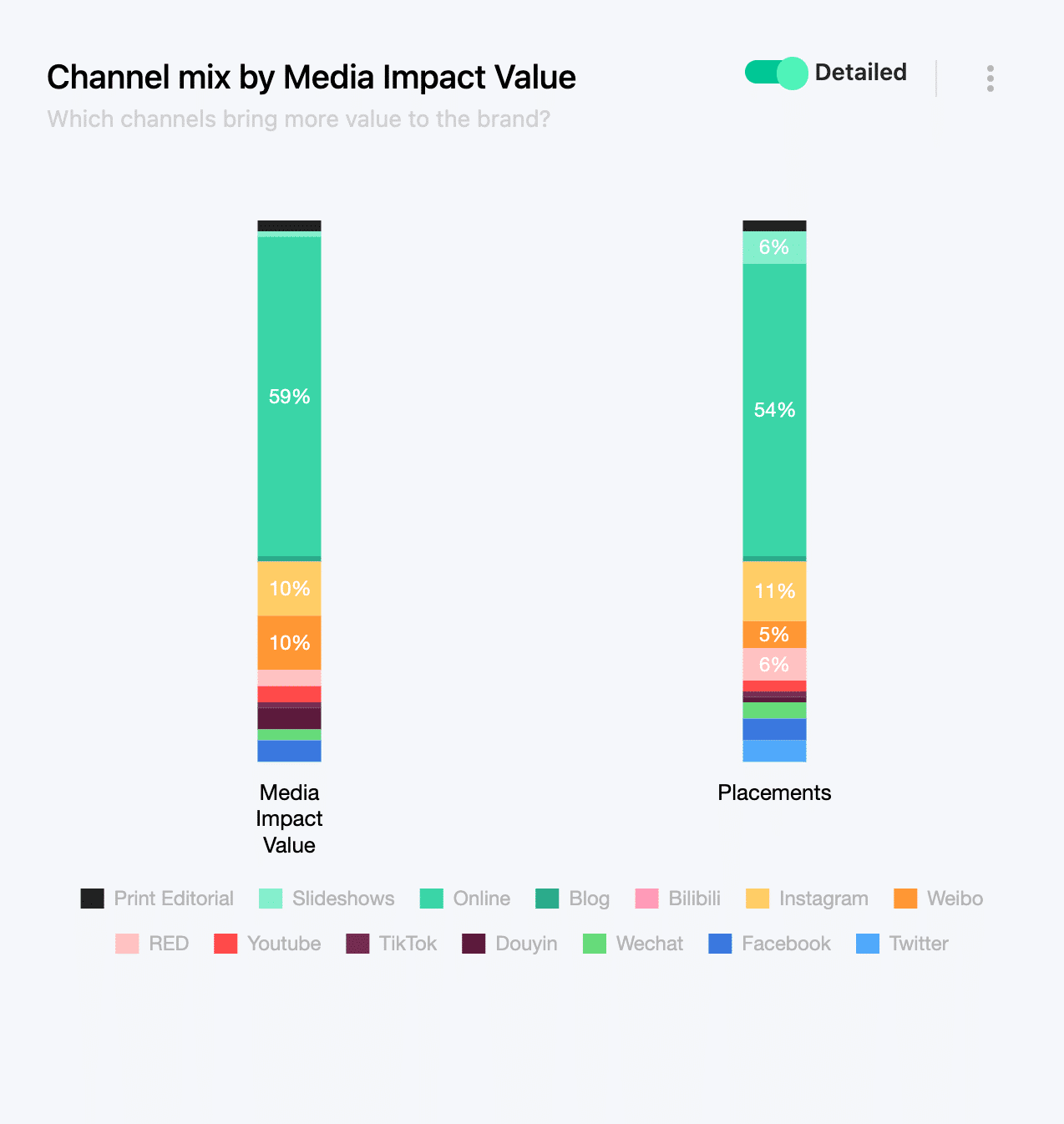

Looking at the Channel Mix, Weibo revealed an average of $8.7K in MIV® per placement, and Douyin $16.5K in MIV® per placement. The Online Channel, in comparison, has a higher percentage, but the average MIV® per placement is lower with $4.5K.

Furthermore, the top placements for Ugg accentuate the importance of campaigns in China’s market. The top five posts for the brand are from Celebrities, Influencers, and Owned Media Voices across Douyin and Weibo. One of these, the top placement, is by Chinese actor Wang Yibo on Weibo, which accounts for $260K in MIV®.

Patagonia

Coming in fourth position for the outdoor fashion brands ranking, Patagonia garnered $4.47M in MIV® across 2.1K placements in October 2022.

Patagonia’s successful coverage is mostly a result of their prominent Media Voice by pitching in $3.0M in MIV®. However, it also has a significant Owned Media Voice which garnered $1.1M in MIV®. At the top of Patagonia’s Key Voices are two of the brands Owned Media Voices: Patagonia’s global account and Patagonia Climbing. In terms of MIV®, the former amassed $834K and the latter $131K. The top placement itself was a Reel by Patagonia which you can see below. The Instagram placement generated $81.1K in MIV®.

On that note, if you’re trying to increase your brand’s awareness on Instagram, using Reels is a must. Leveraging the Reels’ function on Instagram is another strategy which maximizes your visibility on the platform thanks to the Channel’s algorithm, but also because of the consumers keen interest in short-form videos.

Barbour

Last but not least, Barbour gathered $4.4M in MIV® across 1.6K placements. Like all other brands, the brand’s Voice Mix displays the prevalence of the Media Voice with $3.5K in MIV® over 980 placements.

Even looking overall at the key Voices as well as the top placements for Barbour, it mostly consists of Online Media and Print Editorial placements. Considering the former represents $2.4M in MIV® of the brand’s coverage, it illustrates their leverage of Online over Social Media. Amongst the top Voices for the brand, there is the BBC, Gear Patrol, as well as The Sun. The only key Voice which is not a Media Voice is Josie, an Influencer sponsoring Barbour.

In order to reach your audience, leveraging Influencers is always a good strategy because they’ve built their influence through a trusting relationship with their target audience. This is something Barbour implemented across 216 placements, generating $409K in MIV®. Plus, as mentioned prior, with 531K subscribers, Mega Influencer and Youtuber Josie, generated $73.7K in MIV® across 3 placements for Barbour.

How to Benchmark your Outdoor Fashion Brand

This insight aims to help you gain more awareness about successful marketing strategies. It also demonstrates tactics some of the best outdoor fashion brands use to optimize their brand performance.

Do you want to learn more about your brand’s position? How it compares to your competitors? For that, you need a deeper dive into your brand’s performance analytics. This tailored data will help you measure your campaigns’ effectiveness. All by analyzing each Voice and Channel’s performance and benchmark your key results against your competitors.

If this insight has sparked your interest, scroll to find out more below.