As we step into the second half of 2023, premium fashion brands have a unique opportunity to unlock the missing pieces of their strategic puzzle. By harnessing the power of data analytics, brands can make informed decisions that shape their PR and marketing strategies while gaining a competitive edge through benchmarking against industry rivals.

Even amidst a global economic downturn and prevailing political tensions, premium brands are defying odds and experiencing notable sales growth. Consumers, prioritizing quality over quantity, are actively seeking out premium offerings, as highlighted by research from CACI (Consumer and Location Intelligence). Notably, in-person retail experiences have resurged in importance, with shoppers increasingly favoring physical stores over online platforms.

However, brands must not neglect the digital realm. To maintain long-term success, it is vital to retain existing customers and attract new ones by staying ahead of trends and creating valuable content that resonates with your target audience. Adapting to the evolving consumer landscape is essential in meeting their ever-changing expectations.

The fashion industry is undergoing constant market developments, with notable examples such as UK-based retailer Debenhams, now owned by the Boohoo Group, embracing the digital revolution. They have launched a dedicated division on their website, catering exclusively to premium brands. This strategic move demonstrates their commitment to transforming into a comprehensive digital department store, expanding their product offerings, and tapping into new markets. Moreover, sustainability has emerged as a central focus for the fashion industry, prompting premium brands to actively participate in environmentally conscious initiatives, as highlighted by Vogue Business.

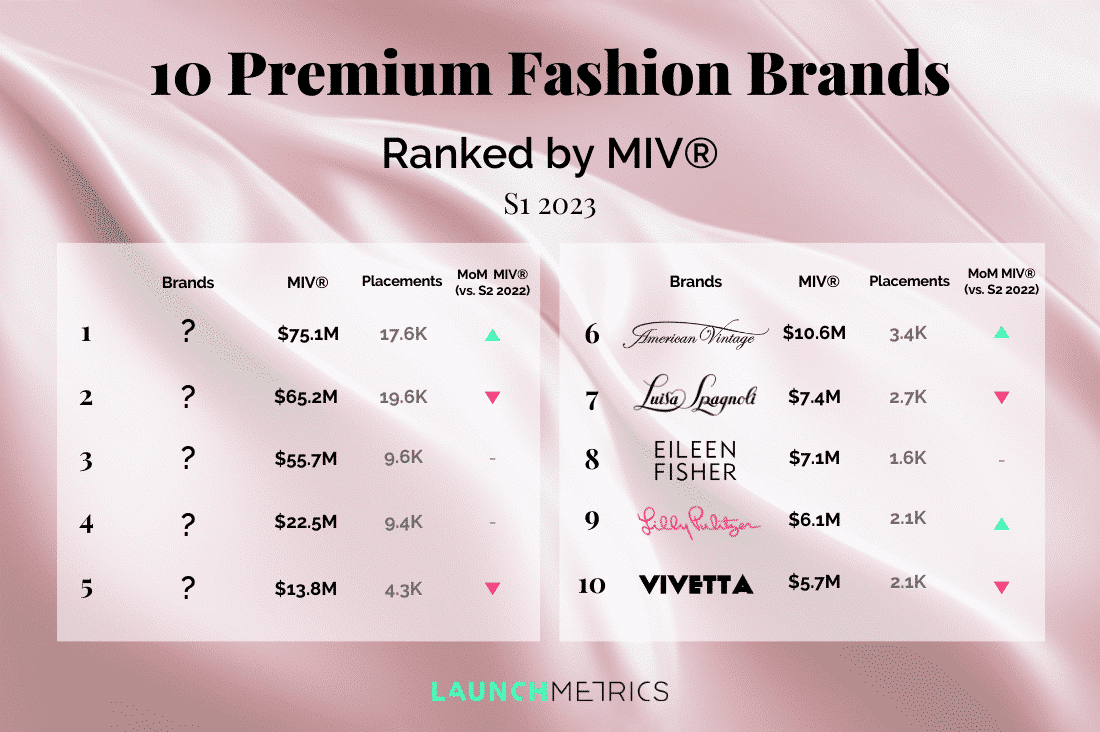

To provide premium fashion brands with a snapshot of the current landscape, we have analyzed the performance of ten successful brands in the first half of 2023. Employing our proprietary algorithm, Media Impact Value™ (MIV®), we have evaluated the impact of media placements and mentions across various channels. This analysis will equip you with invaluable insights into your brand’s performance, as well as that of your competitors. Armed with this knowledge, you can confidently make strategic decisions and secure your brand’s position as a frontrunner in the industry.

In this article you’ll learn…

Which 10 Premium Fashion Brands have been Selected?

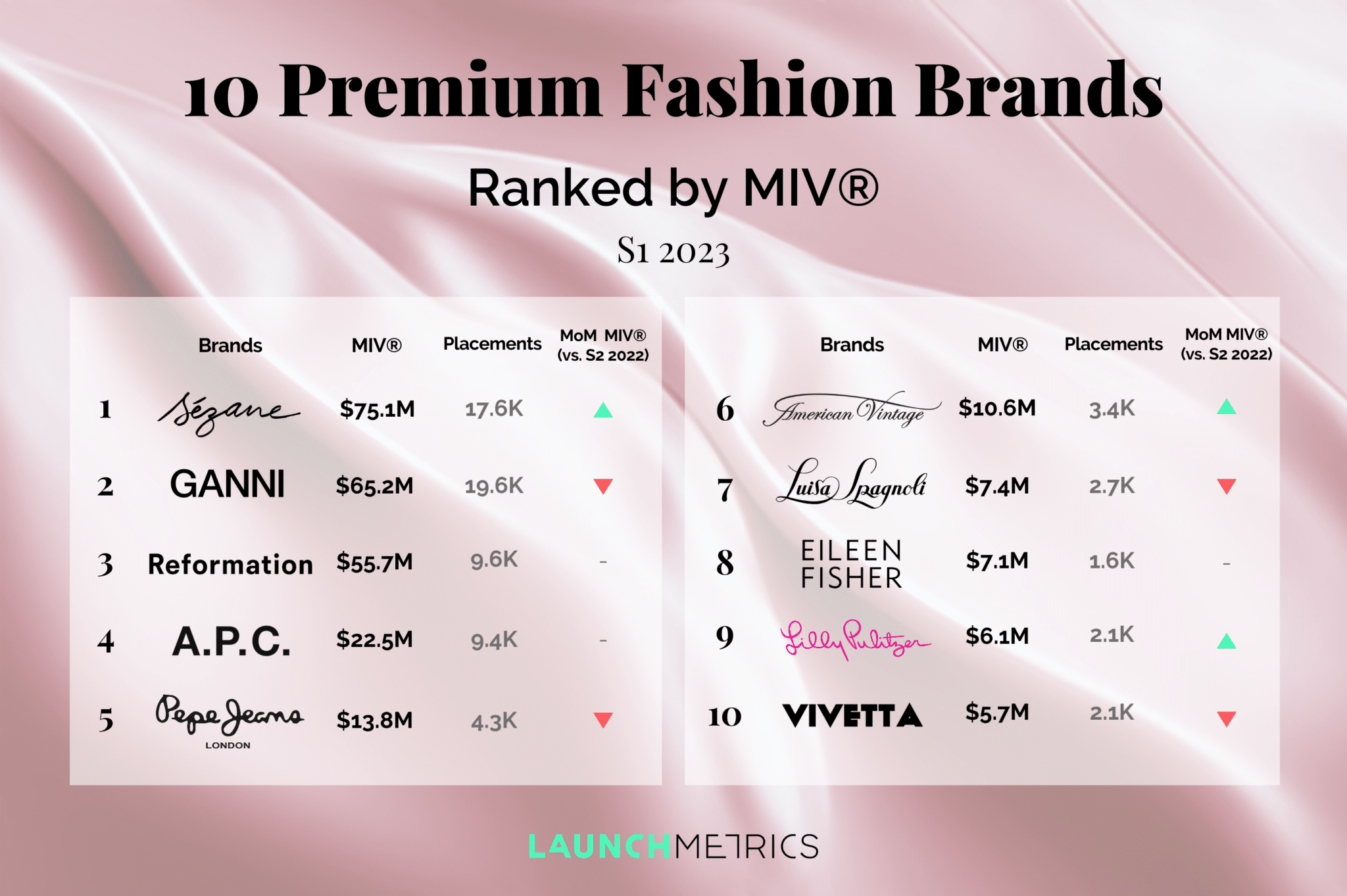

For this competitive benchmarking report, we analyzed the MIV® data in S1 2023, for the following ten premium fashion brands:

- Reformation

- Lilly Pulitzer

- Eileen Fisher

- Ganni

- Sezane

- APC Paris

- American Vintage

- Pepe Jeans

- Luisa Spagnoli

- Vivetta

The infographic below displays the ranking of the ten selected brands and the number of placements they had in S1 2023. These placements factor in social media posts and articles related to specific search queries, as well as consumer interactions with posts, such as tags and comments. It provides a clear picture of some brand’s performance in comparison to others in the industry, allowing you to identify opportunities for growth and maximize your impact.

Voice Mix Benchmark for the Premium Fashion Brands

This infographic represents the Voice Mix Benchmark by MIV® for the ten premium fashion brands in S1 2023.

The Voice Mix is a metric that provides the percentage of each of the five Voices that consumers are exposed to Media, Influencers, Celebrities, Partners, and Owned Media. The rate is based on the total MIV®, which each Voice generated for the premium fashion brands. An awareness of this Voice Mix gives brands a better strategic understanding of the best tactics for themselves or their competitors.

Read on to find out more about the competitive benchmarking and deep dive analysis of the top five of these ten premium fashion brands.

Sézane

Sézane has showcased exceptional performance in S1 2023. Generating $75.1M in MIV® across 17.6K placements, it continuously solidifies its position as a well-known name in the industry. Notably, Sézane experienced a remarkable 68% increase in total MIV® compared to the previous semester.

Analyzing the brand’s performance in S1, a notable spike can be observed between March, where Sézane gathered $9.1M in MIV®, and April, during the buzz surrounding Sézane’s Spring Collection 2023, generating $15.6M in MIV®. Importantly, the brand’s high-performance streak continued in June, accumulating $16.1M in MIV®.

In terms of market, France proved to be the most profitable for Sézane with $35.2M to the brand’s total MIV®. This can be attributed to Sézane’s Owned Media efforts across Channels and the support of notable French media outlets. Additionally, the brand showed success in the US with $10.7M in MIV® and the UK with $8.8M in MIV®.

Examining the Channel split, it becomes evident that Instagram played a pivotal role, delivering the highest global MIV® of $48.5M. The Online Channel followed with $16.3M in MIV®. These findings emphasize the importance of prioritizing Instagram in marketing campaigns. This is particularly the case when aiming to effectively leverage Influencer and Celebrity voices to promote the brand.

Subsequently, Sézane’s top-performing voice in terms of MIV® was the Influencer Voice. It generated an impressive $34.0M, followed by Media with $21.2M and Owned Media with $17.9M. Examining the top placements, the most impactful placement came from Media Voice, Marie Claire, which generated $336K in MIV®.

The following top placement was by California-based influencer Cogey on Instagram, amassing $322K in MIV®. Several Influencers and Celebrities contributed to Sézane’s success, including Chloé Lukasiak, whose Instagram placement generated $220K in MIV®.

By carefully analyzing Sézane’s MIV® and placement data, brands can gain valuable insights into their own market performance. These insights also serve as a foundation for informed marketing and PR initiatives. Therefore, enabling other brands to develop a targeted and effective marketing strategy that maximizes brand exposure, engagement, and impact.

Ganni

Ganni secured an impressive second position among the ten significant premium fashion brands analyzed in this insight. In S1 2023, Ganni accumulated a substantial $65.2M in MIV® across 19.6K placements. While the brand’s performance showed a modest 1% increase compared to S2 2022, it remained consistent throughout the period.

Ganni’s strength lies in its remarkable worldwide reach in terms of MIV®, with notable success in various markets. The brand’s top market was the US, generating $14.4M, closely followed by the UK with $11.1M, and China with $6M.

The Media Voice played a crucial role in Ganni’s success, accounting for 60% of its Voice split. It independently contributed $43M of the total MIV®. Influencers came in second, generating $15.4M in MIV®. On that note, Ganni effectively managed to leverage Key Opinion Leaders (KOLs) to expand its reach in the APAC market.

In terms of the Channel split, Ganni’s focus revolved around the Online and Instagram Channels. They accumulated $32.2M and $18.4M in MIV® respectively. The brand’s key Voices, aside from its Owned Media Voice, predominantly came from Media Voices. These Voices were: Who What Wear US ($3.2M in MIV®), Vogue US ($1.8M in MIV®), and Who What Wear UK ($1.4M in MIV®).

Examining the top placements, Indian actress Alia Bhatt’s Instagram post emerged as the most impactful. Overall, it generated an impressive $972K in MIV®. Filipino-American actress Liza Soberano followed closely with her Instagram post amassing $578K in MIV®. Notably, collaborations with significant KOLs, including 박지후 ($456K in MIV®) and 新木優子 ($171K in MIV®), further contributed to Ganni’s success.

Ganni’s remarkable performance can be attributed to its strategic international collaborations with renowned Celebrities and Influencers. These collaborations maximize the brand’s reach, generating interest on a broader scale and increasing brand awareness. By continuing to leverage these influential partnerships, Ganni can further enhance its visibility and appeal to a wider audience.

Reformation

Reformation came in third place for this selected ranking. It experienced a 45% increase since S2 2022, resulting in $55.7M in MIV® across 9.6K placements in S1 2023. Reformation’s success has evolved dynamically throughout S1. Overall, the brand generated $6.4M in MIV® in January and a noteworthy $13.9M in MIV® in June.

Analyzing the brand’s reach by MIV®, it is evident that the US is the most lucrative market for Reformation. The market generated an impressive $38.4M. The UK follows suit with $9.2M. Delving into the Voice-mix analysis, it becomes apparent that the brand’s impact is largely attributed to the Media Voice, which contributed $37.3M in MIV®. However, Reformation’s influencer activations are equally substantial, accumulating an impressive $12.8M in MIV®.

Looking at the brand’s Channel split reveals that the Online and Instagram Channels have proven to be the most profitable in terms of MIV®. The Online Channel stands out as the most prominent, amassing an impressive $33.0M. Additionally, Instagram has played a significant role, accumulating $17.1M. Notably, the top 9 placements for Reformation were published on Instagram, underscoring its effectiveness. Overarchingly, Celebrity and influencer activations dominated these top placements.

The standout placement for Reformation was an Instagram post by “Never Have I Ever” Netflix-star Maitreyi Ramakrishnan, garnering an impressive $543K in MIV®. Another noteworthy placement was by Social Media Influencer Evelyn Ha 하현정, accumulating $269K in MIV®. Additionally, Reformation has successfully collaborated with notable celebrities such as Sophia Bush, amassing $602K in MIV® across 3 Instagram placements, and Kristen Bell, generating an additional $247K in MIV®. This demonstrates that influencers and celebrities can significantly impact purchasing behavior and reach diverse audiences.

As brands consider incorporating content creators into their marketing strategies, Reformation’s example highlights the impact of embracing influencer and celebrity partnerships to effectively connect with target audiences and foster brand loyalty.

A.P.C. Paris

APC Paris, secured the fourth position in our premium fashion analysis. The brand demonstrated an extensive coverage with an impressive $22.5M in MIV® generated from 9.4K placements. The brand’s successful semester is evident, with a noteworthy 25% increase compared to S2 2022. This showcases APC’s commitment to delivering exceptional products that resonate with consumers.

APC has particularly excelled in Japan, generating a significant $7.2M in MIV®. This performance was followed with France generating $3.4M and the US accumulating $3.1M. Analyzing the Voice mix, Media emerges as the top Voice, generating approximately $17.2M in MIV® across 7.3K placements. However, it is crucial to recognize the contributions of Influencers and Owned Media. The former generated around $3M in MIV®, and the latter played a significant role with $1.7M in MIV®. While the Partners and Celebrities Voices have not proven as impactful, they have generated a combined $612K in MIV®.

Examining APC’s Channel mix, Online emerges as the primary contributor of MIV®, generating an impressive $12.6M. Instagram follows closely as the second-best Channel for the brand, accumulating $5.1M in MIV®. When considering the top placements, both Instagram and Print Editorial take the lead.

APC’s key Voices predominantly come from the Media Voice. The top media outlets were TRILL and Fudge (ファッジ) in Japan which generated significant coverage for the brand. However, though the Influencer Voice did not stand out as the biggest MIV® generator for APC, としみつ【東海オンエア】took the second spot among the top placements on Instagram, amassing an impressive $883K in MIV®.

Partnering with influencers and celebrities can greatly enhance a brand’s marketing efforts and elevate its overall performance. Collaborating with Influencers and Celebrities could allow premium fashion brands like APC to tap even more into their followers’ networks. Not to forget, it could help generate more substantial brand exposure, ultimately leading to heightened brand recognition.

Pepe Jeans

Pepe Jeans, secured the fifth position in this premium fashion ranking for S1 2023. The brand demonstrated a strategic marketing approach, gathering an overall $13.8M in MIV® across 4.3K placements. The brand exhibited a 17% increase compared to S2 2022, indicating a steady growth in MIV® from January ($2.1M) to June ($2.7M).

Pepe Jeans’ success is propelled by multiple regions, though Spain was the most dominant market with $7.0M in MIV®. It was followed by India with $2.5M in MIV® and the UK with $1.4M in MIV®.

Analyzing the Voice Mix, the Media Voice takes the lead, generating $8.6M in MIV®. However, it’s important to highlight the brand’s significant Owned Media presence. In S1, it generated $3.4M in MIV® across 1K placements, closely followed by Influencers with $1.3M in MIV®. Turning to the Channels, Online remains the top-performing channel generating $7.8M in MIV®. On the other hand, Instagram and Facebook also prove to be prominent social media channels for the brand. Instagram gathered $2.8M in MIV®, and Facebook accumulated $2.1M in MIV®.

Examining the key Voices by MIV®, Media Voices: Trendencias ($1.4M), El Mundo ($849K), and Elle ($667K) in Spain played a significant role. However, when looking at the top placements, Influencers and Celebrities make their mark. The top placement for Pepe Jeans is attributed to the Influencer Voice. At the top, Blancs, generated $49.3K in MIV® through her Instagram post. Viral Bhayani secured the second spot on Instagram with her post generating $39.3K in MIV®. Additionally, a placement by Celebrity Voice Lara Álvarez on Instagram ranks fourth with $38.4K in MIV®.

Pepe Jeans has strategically integrated its marketing strategy by effectively leveraging the reach of Influencers and Celebrities through singular placements. Simultaneously, the brand heavily relies on multiple media outlets and its owned media to maximize its brand exposure. This multi-faceted approach allows Pepe Jeans to capture the attention of a diverse audience. In addition, it can help brands achieve a better understanding of the significance of brand recognition.

How to Benchmark your Premium Fashion Brand

This insight aims to help your brand gain more awareness about successful marketing strategies in the fashion industry today. It also demonstrates tactics some of the best premium fashion brands use to optimize their brand performance globally.

Do you want to learn more about your brand’s position? How it compares to your competitors? For that, you need a deeper dive into your brand’s performance analytics. Doing so, you can gain valuable insights into your campaigns’ effectiveness and identify areas for improvement.

If this insight has sparked your interest, start benchmarking your premium brand today by clicking on the link below.