It is essential to be aware of your watch-wear brand’s position in the global market. Do you have the data to truly understand how your brand stacks up against competitors worldwide and locally? This crucial information will help you make informed decisions on the tactics and strategies needed to elevate your brand’s performance.

Our mini-blog series covering 10 performing segmented brands has highlighted rankings on sportswear, e-retail, outdoor fashion, premium fashion, and more. It’s essential to focus on quality over quantity when driving awareness and coverage for your brand. The current state of the watch-wear industry presents a great opportunity for businesses to increase their brand performance. With the rise of smartwatches, renewed interest in traditional designs, and luxury watch brands increasing their prices, consumers are now turning towards premium and contemporary brands. Businesses can position themselves as industry leaders by catering to evolving consumer preferences.

Leveraging the right Channels and the best-performing Voices worldwide can help your brand gain traction and become a powerful asset. Using reliable data analytics and metrics can assist your brand in creating better PR and marketing initiatives by benchmarking your brand against competitors.

In today’s ever-evolving market, it’s more critical than ever to have a deep understanding of your brand’s position and leverage the right channels to reach your audience effectively. Don’t miss out on the opportunity to gain a competitive edge by utilizing data and analytics to inform your brand’s marketing and PR strategies.

In this article you’ll learn…

Which 10 Watch-Wear Brands did we select?

As we approach the midpoint of the first quarter of 2023, it is an opportune time to reflect on the watch-wear industry’s performance during the final quarter of 2022. This insight provides a benchmarking analysis on ten watch-wear brands, utilizing our proprietary algorithm, Media Impact Value™ (MIV®), to measure and benchmark the impact of all media placements and mentions across various voices during a selected period.

We analyzed the MIV® data in 2022, for the following ten watch-wear brands:

- Casio

- Seiko

- Daniel Wellington

- Fossil

- Hamilton

- Citizen

- Victorinox

- Bulova

- Cluse

- Festina

The infographic below displays the rankings of the ten selected brands and the number of placements they had in Q4 2022. These placements factor in social media posts and articles related to specific search queries, as well as consumer interactions with posts, such as tags and comments. It provides a clear picture of some brand’s performance in comparison to others in the industry, allowing you to identify opportunities for growth and maximize your impact.

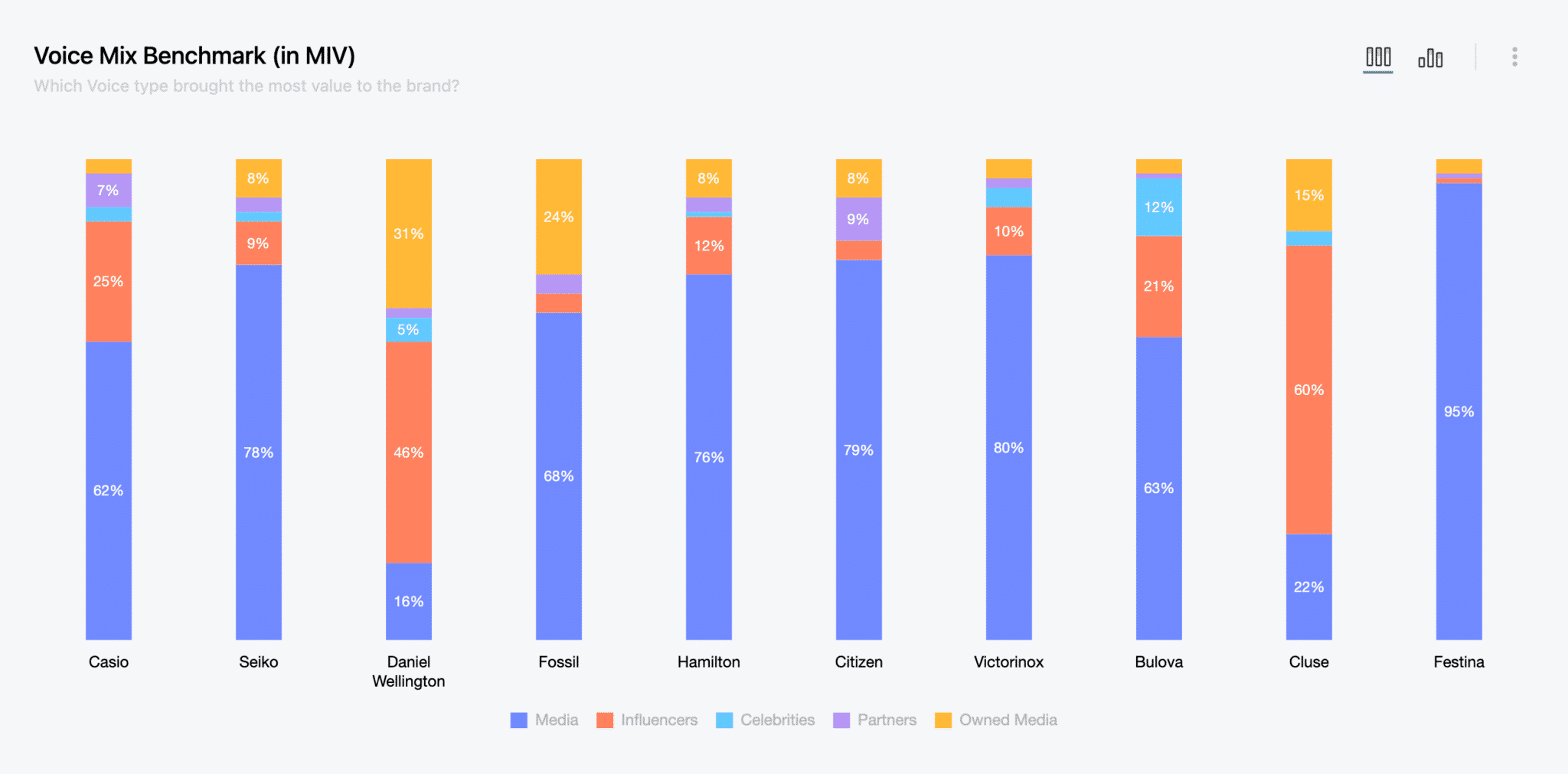

Voice Mix Benchmark for the Watch-Wear Brands

This infographic represents the Voice Mix Benchmark by MIV® for the ten watch-wear brands in Q4 2022.

The Voice Mix is a metric that provides the percentage of each of the five Voices that consumers are exposed to Media, Influencers, Celebrities, Partners, and Owned Media. The rate is based on the total MIV®, which each Voice generated for the watch-wear brands. An awareness of this Voice Mix can give brands a better strategic understanding. They can then determine the best tactics for themselves or their competitors.

Read on to find out more about the competitive benchmarking and analysis of the top five from the selected brands of this watch-wear brands ranking.

Casio

To develop an effective marketing strategy, it is important to analyze the performance of the brand and identify areas of strength and opportunity. Casio, known for its cutting-edge technology and innovation, demonstrated significant growth in Q4 2022. The brand achieved an overall performance boost of 15% compared to the previous quarter. Overall, achieving a total of $32M in MIV® across 13.5K placements throughout that period.

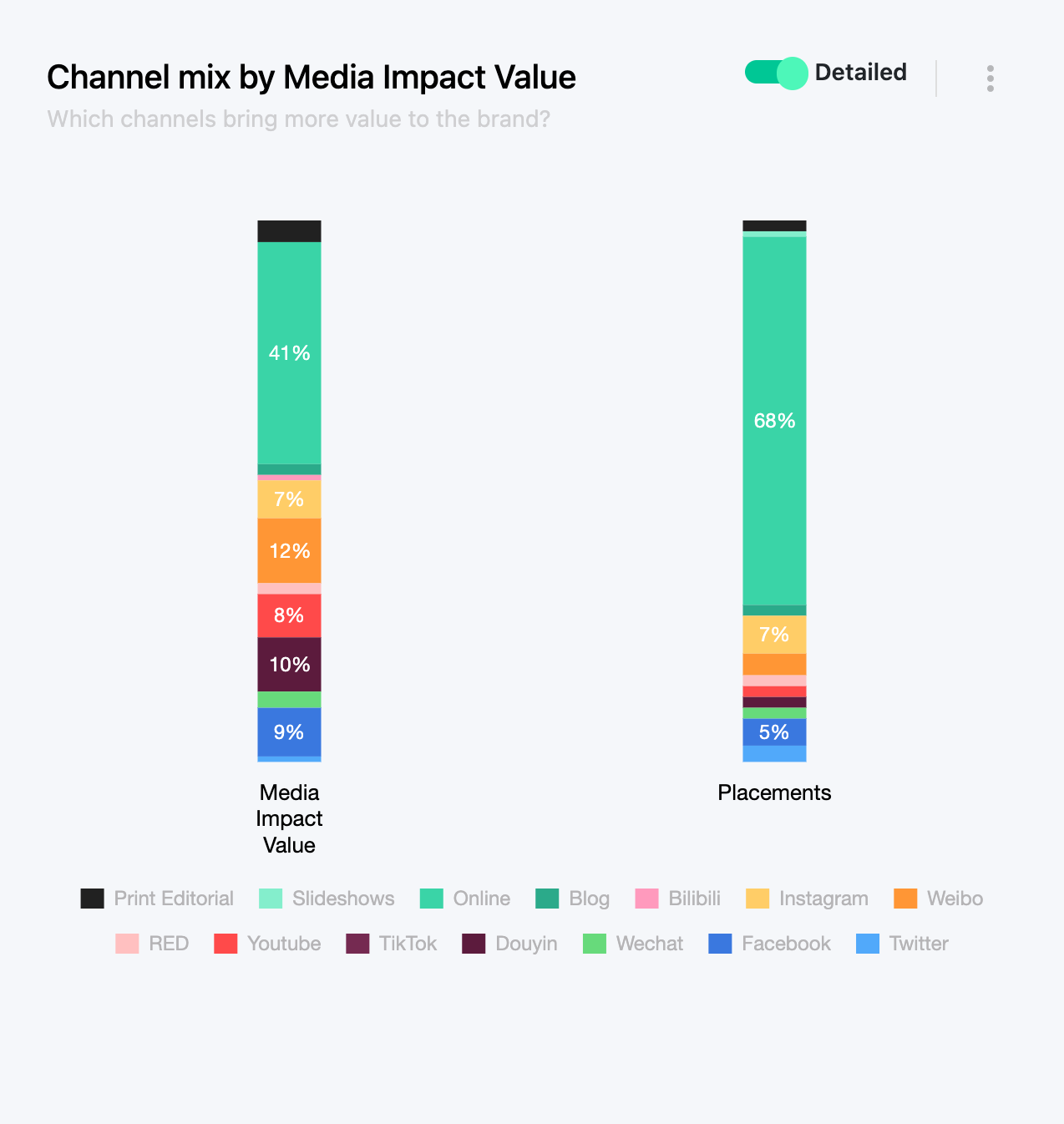

China emerged as the brand’s most profitable market, contributing one-third of its total MIV® and shaping the Channel Mix distribution. The Online Channel yielded the highest global MIV® of $13.2M, followed by Weibo and Douyin, which added $3.9M and $3.4M, respectively. This highlights the importance of prioritizing these platforms in a marketing campaign targeted towards the Chinese market.

Casio’s success can be attributed to its effective use of the Media Voice. The brand garnered $19.9M in MIV® across 11.1K placements, and the Influencer Voice generated $7.9M in MIV® across 1.4K placements. A good example of an effective strategy was Casio’s collaboration with Influencers, actress, Haruna Kawaguchi, and basketball player Rui Hachimura. The promotion of the G-Shock collection on YouTube demonstrates the potential impact of a cross-Voice strategy. It also highlights the importance of leveraging different Voices to reach a broader audience.

These insights can inform a marketing strategy that prioritizes the Chinese market. Brands can utilize a diverse range of Voices to build brand awareness and generate engagement based on this information.

Seiko

Seiko, a leading Japanese watch-wear brand, has made an impressive 22% improvement in this selected brand ranking. The brand generated $22.7M in MIV® across 13.7K placements in the last quarter. This remarkable growth has been led by the brand’s strong presence in the US market. Seiko generated a significant $7.6M in MIV® in the US, followed by Japan ($2.7M) and China ($1.3M).

A major factor in Seiko’s success has been its Media Voice, which contributed 78% of its total MIV®. With $17.6M across 11.6K placements, Seiko’s Media Voice has been instrumental in boosting the brand’s awareness and visibility. In comparison, the influencer voice was not as profitable. While having a higher average MIV® per placement, it only generated $2.1M in MIV® for the brand.

The most successful influencer for Seiko was content creator Damian Broderick who generated $83K in MIV® on his Instagram reel. Otherwise, the other two most popular Influencer placements for Casio were Youtubers Teddy Baldassarre and Alex Costa.

It’s worth highlighting the success of Youtube in Seiko’s brand marketing strategies. Two videos from Owned Media Channel “Seiko Club by Seiko Thailand” were the top placements for the brand. Seiko Prospex SPEEDTIMER 2022 garnered $235K in MIV® and Keep Going Forward: Sustainable for Life (Full Version.) garnered $216K in MIV®. And overall, Youtube generated $3.4M in MIV® for Casio. This demonstrates how the platform provides a unique opportunity to connect with a large and engaged audience. Creating compelling videos and building a community around your brand can effectively promote your brand. This strategy can also increase brand awareness.

Daniel Wellington

Coming third in this watch-wear ranking is the popular Swedish brand, Daniel Wellington. The brand has generated over $12.3M in MIV® across 2.2K placements in Q4 2022. Just like Casio and Seiko, Daniel Wellington has also demonstrated a significant growth from the third to the fourth quarter with 23%. In terms of location, China was the most lucrative market with $2.9M in MIV® for the brand, shortly followed by India ($2.8M) and the brand’s native country ($2.8M.)

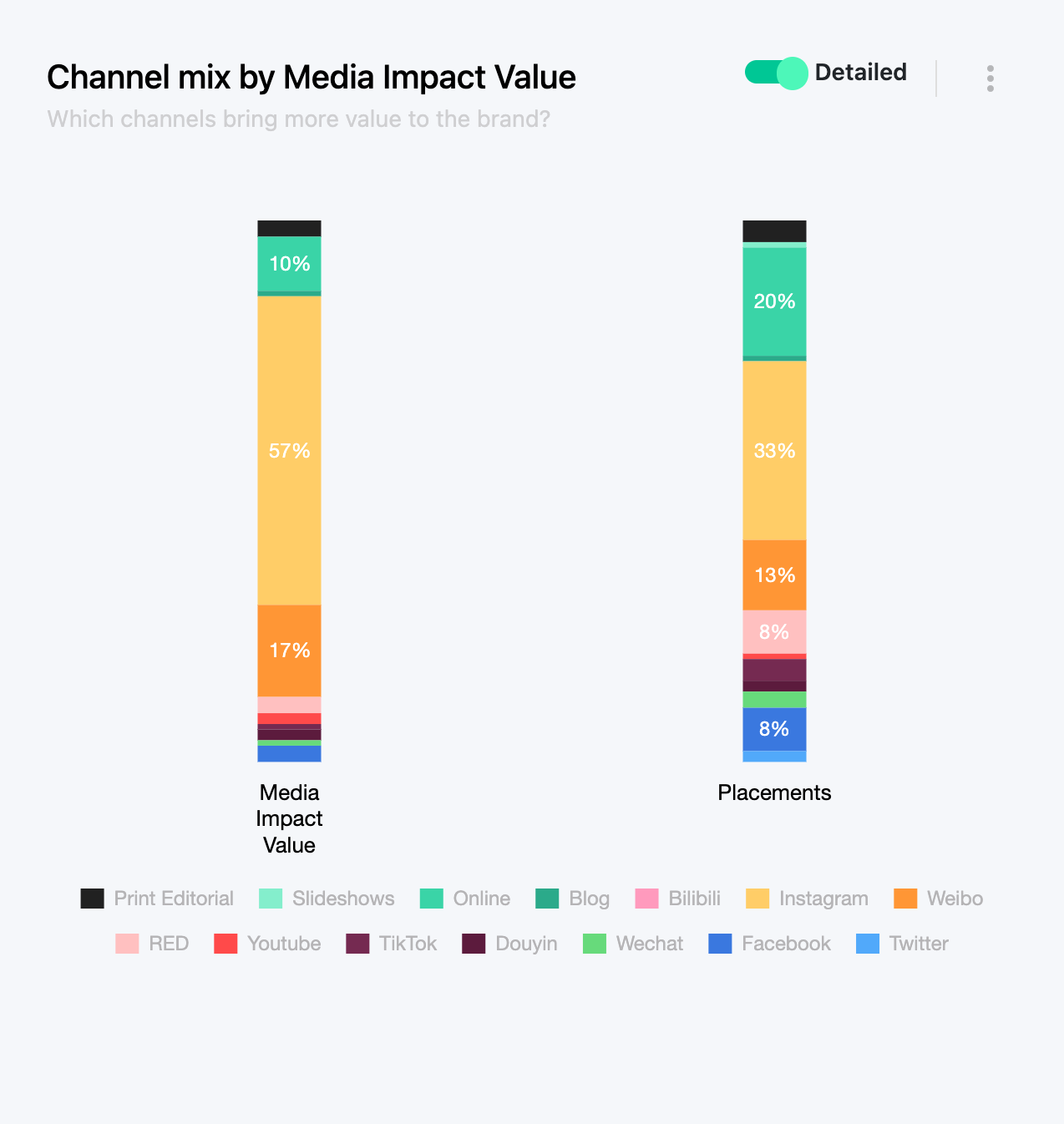

With a focus on refining its brand identity and establishing a significant social media presence, the brand has built an impressive community of nearly 5 million followers on Instagram. By collaborating with numerous influencers and celebrities, the brand has leveraged the power of social media and built a loyal following. This successful strategy is evident in the brand’s Voice mix, with Owned Media and Influencer Voice contributing significantly to its MIV®. Owned Media contributed $3.8M in MIV® across 426 placements, while Influencer Voice contributed a staggering $5.6M in MIV® across 995 placements.

When it comes to the Channel Mix, Instagram is the undisputed champion generating $6.9M in MIV® for the brand. This platform has proven to be the ideal platform for the brand to connect with its audience and build brand awareness. Although Weibo is not to be underestimated, generating an impressive $2.1M in MIV® for the brand. Daniel Wellington’s social media success is further demonstrated by the fact that six of the top ten key Voices for the brand were influencers with their primary Channel being Instagram. One of India’s most popular influencers, Awez Darbar, landed the top placement, generating an impressive $628K in MIV® for the brand. Additionally, among those top ten, two were Daniel Wellington’s Owned Media Instagram accounts. It is evident that Daniel Wellington’s social media strategy has proven to be successful, with Instagram leading the way as the top-performing platform for the brand.

Fossil

Fossil, which ranks fourth in our selected watch-wear ranking, is particularly known for its stylish and functional watches. In Q4 2022, the brand generated $10.2M in MIV® across 5.6K placements with a growth of 9% in comparison to Q3 2022. Location-wise, the market that generated the most MIV® for the brand was the US where it accounted for $3.9M, followed by Germany with $1.6M and then China with $679K.

In terms of Voice mix, Fossil’s brand performance is most due to its Media Voice and Owned Media Voice. The former generated the most MIV® with $7M across 4.2K placements whereas the latter garnered $2.4M in MIV® across 954 placements. Though the Media Voice overall was the most successful Voice in terms of MIV®, the other Voices all represent a higher average MIV® per placement which is significant to factor in when you work on your future marketing strategy.

The Channel mix also demonstrates this push towards a stronger Media coverage with the Online Channel representing not only the majority of placements done with 3.7K, but also the highest MIV® with $5.7M. The top placements from Online came from VNExpress (VN) with $40.5K in MIV® as well as the New York Times (US) with $36.3K in MIV® and Index (HR) with $36.1K in MIV®. Instagram was the second most popular Channel for the brand with an overall MIV® of $1.4M. Its top placement being a post from Fossil’s Owned Media Instagram account in partnership with Harry Potter which generated $40.4K in MIV® and a few influencers, the top being Bibi Alabdulmohsen ($23K in MIV®) and Vaibhav Keswani ($22.8K in MIV®.)

Lastly, we should note that the top placement for the brand resulted from a cross-Voice strategy between Fossil’s Owned Media and Indian Celebrity Kriti Sanon, who collaborated on a YouTube video. Since its publication on December 16th, 2022, the video has generated $233K in MIV®.

Hamilton

Hamilton generated $9.6M in MIV® across 3.4K placements the last quarter of 2022. The brand produces high-quality timepieces that combine traditional craftsmanship with innovative design, earning it a reputation for excellence. Outstandingly, the brand demonstrated a growth of 93% in contrast to its previous quarter— a significant increase. Its most successful market was the US where it garnered $4.6M in MIV®. Italy followed with $980K and China with $498K.

Similarly to Seiko and Fossil, Hamilton’s Voice mix underlines the flagrant success of its Media coverage. Media coverage takes up 76% overall. The Media Voice represents $7.3M in MIV® across 2.6K placements. This increased the visibility of the brand and introduced it to new audiences. This strategy can help create brand awareness, which is an important first step in building a loyal customer base. GQ (US) collaborated with celebrity Christian Bale to publish a YouTube video. It actually secured the top placement for Hamilton, thereby proving the success of using a cross-Voice strategy once again. QG (US) as a key Voice for the brand generated $890K in MIV® across six placements and the Youtube video featuring Christian Bale takes up much of that MIV® with $760K.

To conclude, Youtube is an important Channel for Hamilton being the most popular Channel for the brand overall with 30%. The video platform garnered $2.8M in MIV® for the brand. The Voices were ranging from Media to Influencers with Teddy Baldassarre frequently posting about the watch-wear brand. With the right strategies and execution, YouTube is a powerful tool to help build your brand’s online presence. It can also drive more traffic and sales, as demonstrated by Seiko.

How to Benchmark your Watch-Wear Brand

This insight aims to help you gain more awareness about successful marketing strategies. It also demonstrates tactics some of the best contemporary watch-wear brands use to optimize their brand performance globally.

Do you want to learn more about your brand’s position globally and locally? How it compares to your competitors? For that, you need a deeper dive into your brand’s performance analytics. Doing so, you can gain valuable insights into your campaigns’ effectiveness and identify areas for improvement.

Additionally, you can measure your brand’s global and local position. You can then compare it to your competitors, helping you make informed decisions to optimize your brand performance.

If this insight has sparked your interest, start benchmarking your watch-wear brand today by clicking on the link below.