In the dynamic landscape of high-street makeup brands, the pursuit of excellence is never ending. Understanding your brand’s global standing is an essential asset in navigating this ever-evolving market. Do you have insights into both your local and global competitors? To maintain a strategic advantage, understanding your position in relation to other brands is crucial. Moreover, delving beyond brand performance, it’s essential to grasp how your products are categorizing themselves perfectly in this competitive landscape.

Having passed the halfway mark of 2023, challenges continue to unfold. Escalating expenses, potential economic instability, and heightened global political and interest rate concerns remain persistent. Despite these factors, the high-street makeup industry demonstrates resilience and adaptability. Reports, including projections from esteemed sources like McKinsey & Co, suggest the global beauty market is poised to reach approximately $580B by 2027, with a projected annual growth rate of 6%. Amid economic uncertainty, the industry displays growth indicators guided by promising market trends.

The landscape of high-street makeup trends is influenced by a younger demographic that is reshaping industry norms and preferences. Influencers, key opinion leaders, and celebrities play a pivotal role in shaping these trends, steering consumer choices through their trusted endorsements. Recognizing the impact of these influential figures is predominant, given their impact over brand appeal and consumer engagement.

Additionally, we anticipate an intensified competitive landscape. Aligned with trend-driven dynamics, a substantial 42% of respondents in McKinsey’s 2023 consumer survey spanning China, France, Germany, Italy, the UK, and the US expressed an interest in trying new brands.

With this backdrop, we investigated how five performing high-street makeup brands align themselves with evolving trends and consumer preferences. This strategic journey paves the way toward sustained success within this dynamic and ever-evolving market.

In this article you’ll learn…

Which 5 Makeup Brands have been Selected?

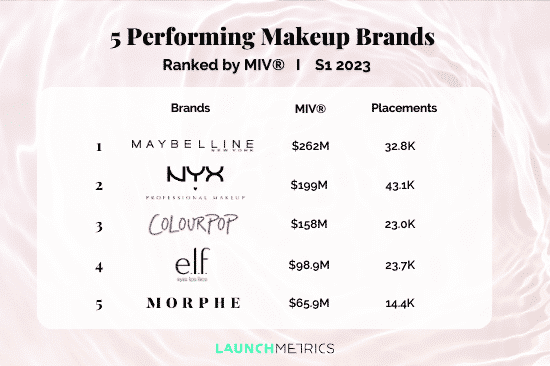

This insight provides a benchmarking analysis on five successful makeup brands in S1 2023, utilizing our proprietary algorithm, Media Impact Value™ (MIV®), to measure and benchmark the impact of all media placements and mentions across various voices during a selected period.

- Maybelline

- NYX Cosmetics

- ColourPop

- E.L.F. Cosmetics

- Morphe Cosmetics

The infographic below displays the ranking of the five selected high-street makeup brands and the number of placements they had in S1 2023. These placements factor in social media posts and articles related to specific search queries, as well as consumer interactions with posts, such as tags and comments. It provides an overview of some brand’s performance in comparison to others in the industry, allowing you to identify opportunities for growth and maximize your impact.

Voice Mix Benchmark for the Makeup Brands

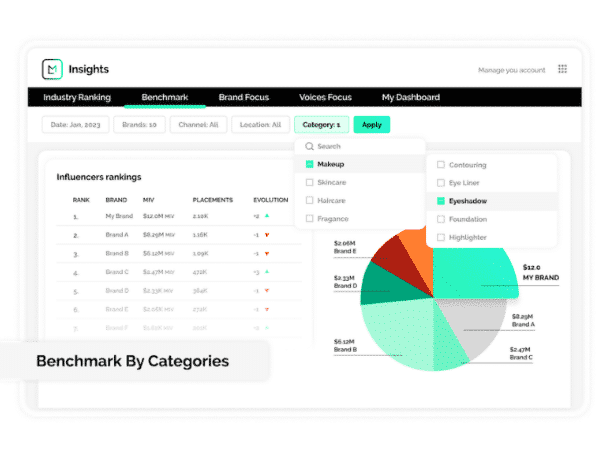

This chart above represents the Voice Mix Benchmark by MIV® for the five high-street makeup brands in S1 2023.

The Voice Mix is a metric that provides the percentage of each of the five Voices that consumers are exposed to: Media, Influencers, Celebrities, Partners, and Owned Media. The rate is based on the total MIV®, which each Voice generated for the beauty brands. An awareness of this Voice Mix gives brands a better strategic understanding of the best tactics for themselves or their competitors.

Read on to find out more about the competitive benchmarking and analysis of these five brands.

Maybelline

Maybelline’s achieved an impressive $262M in MIV® across 32.7K placements, solidifying its position within the industry. Particularly noteworthy is the brand’s remarkable 17% growth in total MIV® compared to the S2 2022.

The US market emerged as the most lucrative, contributing a significant $66.5M to the brand’s overall MIV®. This success can be attributed to Maybelline’s robust Owned Media endeavors and the endorsement of prominent American Celebrities and Influencers, with Gigi Hadid, one of the brand’s ambassadors, proving her worth.

It becomes evident that Instagram has played a pivotal role, yielding the highest global MIV® of $90.7M. Following closely is Facebook with $56.0M in MIV®. These insights underscore the efficacy of Maybelline’s social media strategies, particularly on Instagram, a platform that has outperformed the Online channel, which generated $26.0M in MIV®. Therefore, when seeking to harness the potential of Influencer and Celebrity Voices for brand promotion, a strategic emphasis on Instagram, proves highly advantageous.

Subsequently, the most impactful voice for Maybelline is the Owned Media Voice, generating a notable $127M in MIV®, closely trailed by Influencers with $86.9M in MIV®. The Media Voice ranks third with $35.7M in MIV®. A closer examination of these key Voices reveals that Owned Media Voices have wielded the most influence worldwide, spanning multiple channels tailored to each respective country.

In terms of placements, Gigi Hadid’s Instagram post takes the lead with a substantial $977K in MIV®. Several Influencers also contributed significantly to Maybelline’s success, with Mikayla Nogueira’s TikTok video amassing $629K in MIV® and Grace Wells’s TikTok video securing $599K in MIV®.

These insights serve as a cornerstone for well-informed marketing and PR initiatives, empowering other brands to craft effective strategies that optimize brand exposure, engagement, and overall impact.

NYX Cosmetics

Ranking second in our high-street makeup insight is NYX Cosmetics. Throughout S1 2023, NYX displayed a modest yet noteworthy 3% growth compared to the previous semester. The brand achieved a total MIV® of $199M across 43.1K placements in S1, indicating a promising market performance.

The US market emerged as the most lucrative, contributing a substantial $95.4M to NYX’s total MIV®. This accomplishment can be attributed to the brand’s concerted coverage efforts in the region, coupled with the presence of numerous Influencers who effectively ignited interest. Additionally, Instagram led the way with the highest global MIV® of $106M, closely followed by Online and TikTok at $26.6M and $19.9M, respectively.

The Influencer Voice which proved the most effective, generating $94.2M in MIV® across 18.9K placements. The Owned Media Voice also made a significant contribution, accounting for $60.9M, while the Media Voice followed closely with $39.1M. A striking example of a successful Cross-Voice strategy was observed with Partner Voice Coachella, who posted an Instagram reel featuring not only NYX but also rapper Bad Bunny. This placement garnered $167K in MIV®, with a potential reach of 2.5M.

In terms of top placements, NYX’s collaboration with Influencers emerged as the most profitable approach. Leading the chart was an Instagram post by Narins Beauty, generating an impressive $416K in MIV®. Following closely was Elnaz Golrokh, whose Bronze Gold Smokey eye makeup tutorial on Instagram generated $327K in MIV®. Remarkably, the top ten rankings were entirely dominated by various Influencers.

Through an implementation of an Influencer Voice-targeted approach, NYX maximized its credibility, propelled growth in MIV®, and harnessed the strengths of this Voice type to orchestrate impactful marketing campaigns.

ColourPop

ColourPop secures the third spot in our high-street makeup analysis, amassing a noteworthy $158M in MIV® from 23.0K placements. Despite a 20% decrease compared to the preceding semester, these figures still attest to ColourPop’s commitment to delivering exceptional products that resonate with consumers.

Similar to NYX Cosmetics, ColourPop exhibited exceptional performance in the US market, generating a substantial $104M in MIV®. While its performance was comparatively less robust in the rest of the world, this disparity hints at the brand’s substantial potential for geographical expansion.

In terms of the brand’s Voice composition, Influencers took center stage in S1, yielding approximately $93.0M in MIV® across 15.2K placements. Notably, the brand’s Owned Media efforts played a crucial role, contributing around $51.2M in MIV® across 2.9K placements. On the other hand, the Media Voice exhibited limited impact, contributing just $10.9M in MIV®.

Turning to ColourPop’s Channel distribution, Instagram emerged as the primary MIV® contributor, generating an impressive $104M, constituting 66% of the brand’s total MIV®. YouTube followed suit with $26.4M in MIV®, followed by TikTok with $11.0M. Given the relatively diminished influence of the Media Voice, the Online Channel’s contribution amounted to $7.6M in MIV®.

ColourPop’s key voices predominantly came from Influencers and Owned Media Voices, with notable figures such as Mariale Marrero, Mei Pang, and Rosy McMichael driving substantial coverage for the brand. The top placement for the brand was a Valentine’s Day makeup tutorial by Influencer Steph Hui on Instagram. Her post on February 13th garnered an impressive $588K in MIV®.

Through Influencer partnerships, makeup brands can not only showcase their products through makeup tutorials and trend-setting videos but also tap into the followers of these Voices, enhancing brand recognition.

E.L.F. Cosmetics

E.L.F. Cosmetics secures the fourth spot in our ranking, showcasing impressive growth in its market presence with a substantial $98.9M in MIV® across 23.7K placements, marking a notable 34% increase in brand performance.

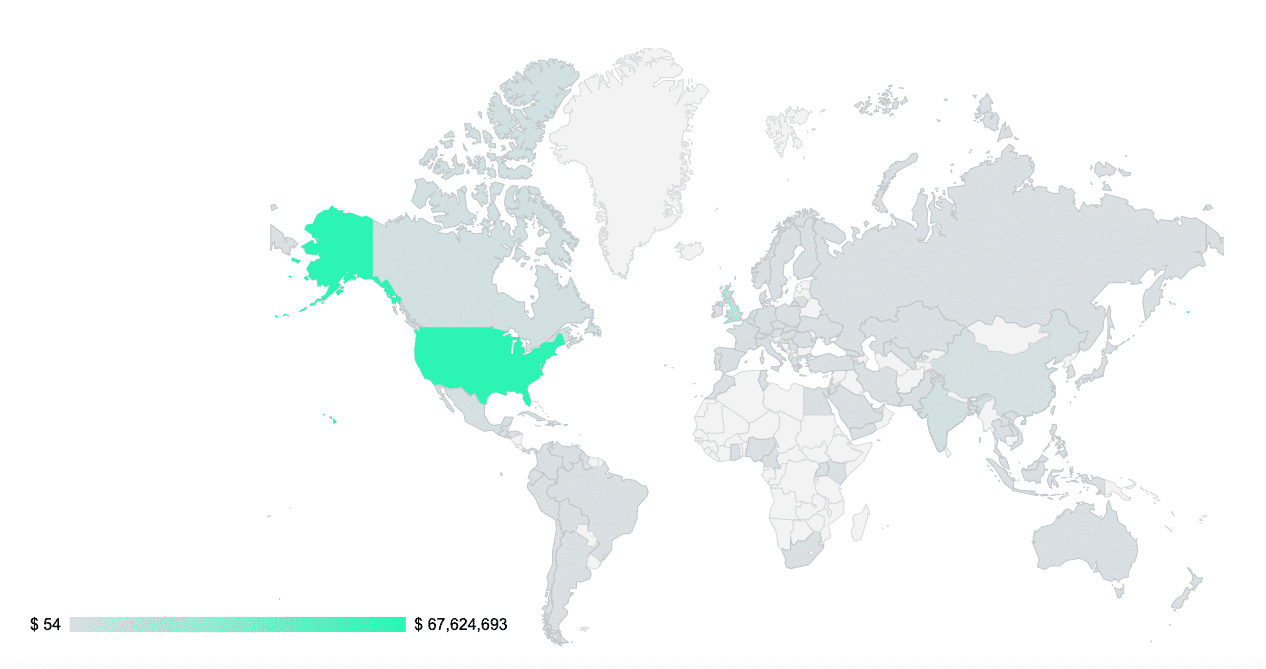

Throughout S1, E.L.F. maintained a consistent performance, generating $16.7M in MIV® in January and $17.0M in MIV® in June. However, a closer look at market performance reveals E.L.F.’s exceptional performance in the US, where it accumulated a significant $67.6M in MIV®, closely followed by the UK with $11.8M.

Just as one highlights a growing makeup trend, it’s essential to recognize the three distinct Voices propelling E.L.F. forward. The most prominent Voice is the brand’s Influencers Voice, emerging as a significant contributor with $53.2M in MIV® across 10.6K placements, accounting for 54% of its total MIV®. Next, the Owned Media Voice generated $23.7M in MIV® across 32.7K placements. Similarly, the Media Voice contributed a substantial $18.4M in MIV® across 9.6K placements. By prioritizing the Influencers Voice, E.L.F. Cosmetics can sustain its remarkable MIV® performance and continue driving growth in the competitive beauty market.

Analyzing E.L.F.’s MIV® performance, the brand’s Influencer and Owned Media Voices emerge as pivotal contributors to its success. The key Voices were led by E.L.F.’s own global Voice, amassing $23.0M in MIV® across 2.9K placements, closely followed by recognized Influencers: Mikayla Jane Nogueira, iamtamjeed, Christxiee, and Danielle Marcan.

In terms of top placements, makeup artist and Influencer “Luvorboy 💫🚏” stands out as the most impactful Influencer for the brand, generating an impressive $692K in MIV® from a single TikTok video placement. Additionally, E.L.F. benefited from a top-performing placement by Influencer Beauty by Mikayla Jane, contributing $371K in MIV®.

This underscores the brand’s potential to further cultivate influential relationships with recognized personalities, expanding its reach and connecting with a wider audience.

Morphe Cosmetics

Concluding our analysis of high-street makeup brands, we turn our attention to Morphe Cosmetics, securing its place in the ranking with a noteworthy $65.9M in MIV® across 14.4K placements during S1 2023. Similar to ColourPop, Morphe’s total MIV® reflects a 20% decrease from the previous semester.

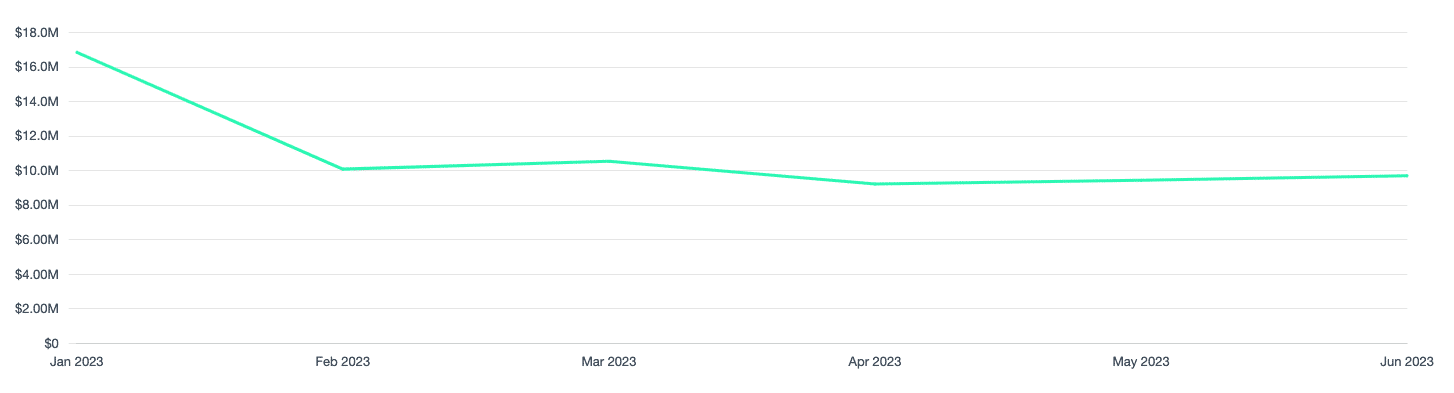

Notably, Morphe experienced a MIV® surge in January, amassing $16.9M, followed by a dip to $10.1 M in February, maintaining a relatively consistent performance throughout the semester. Geographically, the US remains the most profitable market for this beauty brand, contributing a substantial $39.0M to Morphe’s overall MIV®. The UK emerges as the next best-performing market, contributing an MIV® of $6.3M.

Delving into Morphe’s Voice mix, it’s unsurprising to find that Influencers hold a significant presence, generating approximately $44.7M in MIV® across 11.3K placements. Owned Media also plays a pivotal role in the brand’s success, contributing around $12.6M in MIV® across 482 placements.

Taking a closer look at Morphe’s Channel mix, Instagram emerges as one of the most impactful platforms, generating $46.5M in MIV® (70%). YouTube follows closely behind with $8.5M in MIV®, while the Online Channel registers $5.4M in MIV®.

Morphe’s top placements predominantly stem from Influencer collaborations on Instagram and YouTube, highlighting their preference for harnessing the power of social media platforms. The brand’s key Voices include Morphe Worldwide, Influencer Elnaz Golrokh, and Samii Herrera. The most noteworthy placement comes from “JACLYN TORREY💍” on Instagram, generating an impressive $535K.

Overall, the strategic use of Influencers proves to be a potent avenue for connecting with the target audience, leveraging the existing trust that Influencers have established with their followers. By perpetuating these collaborative efforts, Morphe can potentially elevate its MIV® even further and solidify its brand presence. Exploring partnerships with notable Celebrities could also offer new avenues of growth and exposure for the brand.

High-Street Makeup: Key Takeaways

Ultimately, these insights of Maybelline, NYX Cosmetics, ColourPop, and E.L.F. Cosmetics offer valuable insights for high-street makeup brands aiming to excel in the competitive beauty industry.

- Geographically, North America emerged as a key market for all brands, emphasizing the need for targeted regional strategies.

- Influencer collaborations consistently drove MIV® and audience engagement, highlighting the importance of authentic Influencer partnerships.

- Social media, especially Instagram, played a pivotal role in MIV® generation, emphasizing the need for a strong social media presence. Owned Media Voices, like brand-owned platforms, were effective in boosting MIV® and maintaining brand consistency.

- Diversifying across channels, including YouTube and TikTok, allowed brands to reach a wider audience and maximize MIV®.

- Celebrity endorsements, as seen with Gigi Hadid and Maybelline, bolstered credibility and expanded brand reach.

- Adapting to trends, such as seasonal campaigns or tutorials, led to higher MIV® and consumer engagement.

- Cross-Voice collaborations combined Influencers, Celebrities, and brands for amplified impact.

Regular evaluation and adjustment of strategies based on MIV® insights are crucial for ongoing success. By integrating these insights, makeup brands can enhance brand recognition, deepen consumer engagement, and thrive in the dynamic beauty industry.

How to Benchmark your High-Street Makeup Brand

This insight aims to help you gain more awareness about successful marketing strategies. It also demonstrates tactics some of the best makeup brands use to optimize their performance globally.

Do you want to learn more about your brand’s position? How it compares to your competitors? For that, you need a deeper dive into your brand’s performance analytics. Doing so, you can gain valuable insights into your campaigns’ effectiveness and identify areas for improvement.

If this insight has sparked your interest, start benchmarking your beauty brand today by clicking on the link below.