In this article you’ll learn…

Why track category and beauty product performance?

Consumer trends and marketing activity throughout the beauty industry are constantly evolving. Is it any wonder, when you consider the sector’s vast amount of categories? Beauty product performance tracking can become a minefield.

Skincare, for instance, was the leading beauty category in 2022. It accounted for 41% of the global market and revenue is projected to reach $177BN by 2025.

Great news if you’ve got skin in the skincare game – but did you know eyewear cosmetics was one of the highest-performing beauty subcategories? With so much campaign data to sift through, and growing competition in each market, how can your product launch make an impact?

There’s a lot to learn from this diverse industry. Whether you’re a hero brand launching your latest moisturizer, or a multi-axis brand venturing into the haircare sector, understanding beauty performance – in just one or across multiple categories – is key to both marketing and product launch success.

Let’s break down why beauty brands should track product category performance

Beauty brands are diversifying at pace and scale

Take reality star turned beauty CEO Kylie Jenner, for example. Since launching three-shade lip kits in 2015, Kylie has formed a $900M empire by monitoring and venturing into new categories.

Kylie Cosmetics, Kylie Skin, and Kylie Baby were no doubt molded by extensive market research and competitor category benchmarking. The brand accelerated a new course of makeup promotion with its strategic approach – utilizing digital and social media to create launch buzz.

From the start, the brand’s lip kits were promoted through Owned Media (Snapchat), foregoing the traditional retail partner route opted by most beauty brands. This gave Kylie direct contact with her customers, meaning full control over brand messaging. Now, the brand competes with beauty giants such as L’Oréal and Estée Lauder. There’s no doubt that competitor analysis will be ongoing and help to sustain the empire’s success and beauty product performance.

Cross-market category trends can’t be ignored

Even single-category ‘hero’ brands know there’s no ‘one-size-fits-all’ when it comes to product promotion. While Kylie successfully drove e-retailer activity through social selling, trends beyond brand control can have a huge impact across categories.

Following the pandemic, 22% of women stated they’d changed their skincare regime entirely. Without access to campaign performance for your own products, and across the competitive category landscape, there’s no quantifiable way to reveal where new trends and opportunities lie and where marketing efforts are wasted.

For instance, increasingly, consumers are opting for clean, natural ingredients and holistic brand messaging that aligns with their personal ethical values – particularly Gen Z and Millennial buyers. Competitor insights have shown that many brands have cottoned on to this shift in skincare consumption. In 2022, P&G acquired indie skincare brand Tula. Famille C, the holding company which owns Clarins, acquired ‘natural’ makeup brand, Ilia. This natural ingredient need has also spilled into the fragrance market.

A more ‘natural’ trend has even been identified in the makeup sector, as sheer lipglosses shine. Data from our own insights found that, during Fall/Winter season of Fashion Week 2023, ‘Lipgloss’ was one of the most searched trends, generating $8.8M in Media Impact Value™ (MIV®).

How can this data inform your own product launch and improve beauty product performance? By tapping into more granular category competitor insights, brands can reveal which campaign trends and messaging are being activated (and audiences are resonating most with). In turn, this helps brands to determine current trends and opportunities in the market to drive more value in that category.

Beauty category Voice data drives strategy success

Knowing your product’s most appropriate Voice (that’s Media, Influencers, Celebrities, Partners and Owned Media) – and which Channel to operate through – will increase its performance in your operating category. The influence of social media and Influencers in particular play a big role in the accelerated growth of all beauty categories.

But there are still nuances to consider. One popular skincare category trend involves a focus on ‘routine’. Therefore, consumers are engaging with Skincare Influencers who boast an ‘expert’ status. These specialists are considered better equipped to comment on skincare routine techniques and products and should be considered more desirable by brands marketing in this category.

Pre-product-launch, brands should research which Voice is best received amongst category and product competitors. Comparing this data with the Voices that best align with your brand message and product ethos will ultimately determine your strategic brand allies.

Micro-Influencers – the perfect beauty product category partner?

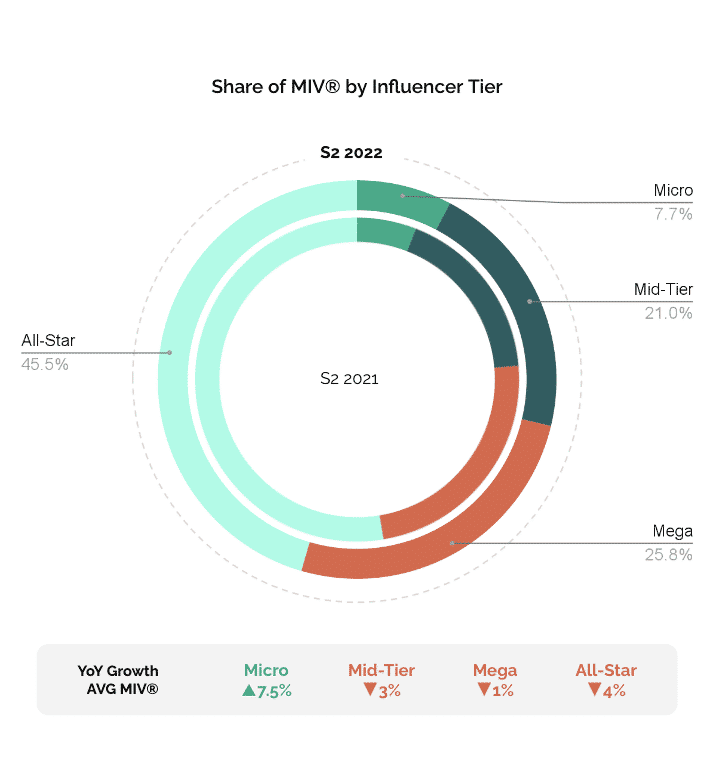

The use of Micro-influencers in the beauty sphere is growing, as online audiences deem them more in touch with the everyday consumer. These influencers have seen the biggest growth in MIV® year-on-year (7.5%) – even higher than All-Star or Mega Influencers.

Researching the beauty product performance of competitors’ micro-influencer partnerships will reveal the media impact of these collaborations in specific categories. In the same vein, analysis of User Generated Content (UGC) can be key to category launch success. Identifying product mentions through UGC gives visibility into ongoing conversations around your and your competitor’s beauty products.

Voice analysis helps brands to identify top performers, top placements, and most aligned advocates. You can even review Voice reach and how many placements it took for your competitor’s product to make a media impact. Assessing this data prior to launching a product in your chosen category will better predict and ensure the right level of ROI. It’ll even offer you insights for future launches, promotions, and partnership investments.

Beauty Category Performance: Go Global or Local

If you don’t understand where your product features in the greater competitor landscape, you won’t be able to grow. Defining your product and category stance globally, and locally, is crucial to making an impact in your targeted space.

If you’re keen to launch a new serum, for example, you might be interested to know that the Asia-Pacific region is the current skincare leader, owning over 40% of the market. Analysis of the top performers in this region will help to underpin your own strategy if you’re looking to enter the China market. Outside of China, reviewing your chosen region will improve your chances of more successful reach and coverage.

Modern digital tools can shed light on where your brand’s biggest opportunities lie, and how fellow competitors launching serums have previously performed in that region. These golden insights will help to formulate not just your campaigns, but also your local and global budgets. By identifying any new opportunities or missing data, you can refine your value proposition.

Making a mark in your Beauty Category Market

Once you understand what differentiates your beauty product from its direct competitors (and the category’s top players), you can begin to promote its qualities more strategically. Get ready to set your future products apart from any crowded category market.

Whether you’re comparing serums to serums (or hair oils to eyeshadows), by harnessing these insights in your marketing efforts, you’ll make it even clearer to consumers why they should switch to your brand.

Looking for a powerful, all-in-one solution that can deliver the metrics for your brand to benchmark and succeed across all major product categories?

- Get granular performance data and explore up to 54 industry sub-categories including eyeshadow, serums, conditioners, body fragrance, and more!

- Understand if you’re performing within the top 100% of your chosen category

- Uncover opportunities within your more successful categories and product lines

- Utilize your marketing budget more strategically

- Benchmark your brand performance vs. your competitors on category or product levels

- Contact our team today to discover more about Launchmetrics Insights and dramatically improve your beauty product performance today, no matter the category.