When it comes to premium footwear, brands are constantly striving to distinguish themselves from their competitors. The global market is widespread and competitive, so being aware of your brand’s position for one is imperative. But additionally, it’s essential to be aware of your competitors both locally and worldwide. Otherwise, it could mean missing opportunities to improve your brand’s performance and becoming a leader in the industry.

Notwithstanding the unprecedented dip of the market during the COVID-19 pandemic years, according to Statista, the footwear market is expected to grow annually by 3.47%, with a projected market volume of $398B in 2023. Furthermore, the United States is anticipated to generate the most revenue, with $88.5B in 2023. Despite these promising growth projections, the footwear market, like most, is facing new challenges, such as the impact of inflation on consumer behavior which has drastically affected the market. A survey of over 1K adults conducted by Alix Partners found that inflation is causing 43% of women and 30% of men to deprioritize footwear purchases. As a result, footwear brands must be more aware of not only their operations and supply chains, but also their coverage on online and social channels to adapt to the evolving market and consumer demands.

Looking back to assess your brand’s performance is just as crucial as keeping an eye on the future. With a better understanding of how they are perceived by consumers, footwear brands can adjust their strategies accordingly. Additionally, with accurate insights into industry trends, cultural changes and consumer behavior, premium footwear brands can adapt to changing market conditions and stay ahead of the competition. By using data-driven insights to inform your decisions, you can make sure that your brand stands out from the rest and boost your brand performance.

In this article you’ll learn…

Which 5 Footwear Brands have been Selected?

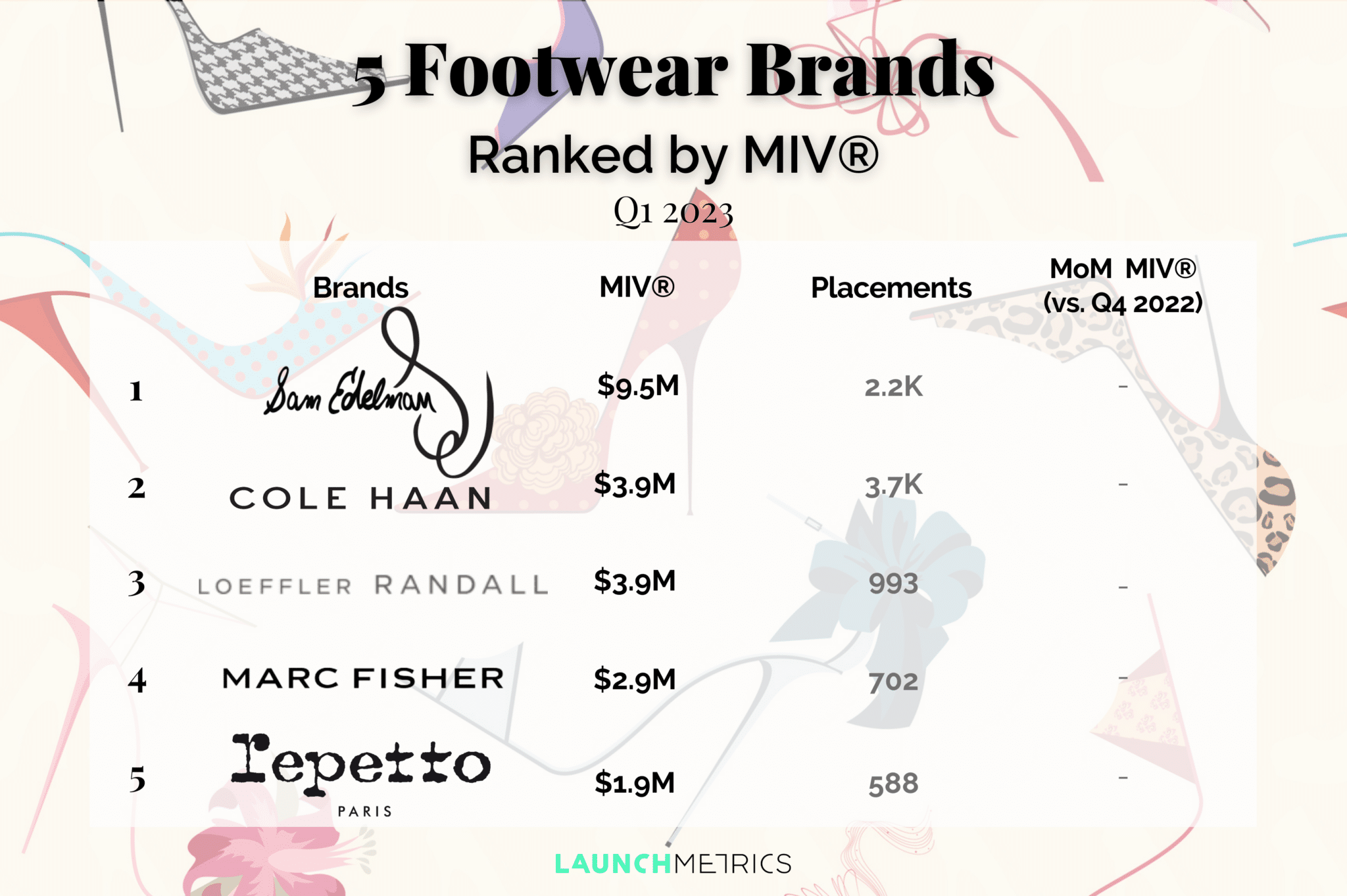

Discover the five performing premium footwear brands that made significant impact in the first quarter of 2023. Our comprehensive benchmarking analysis, powered by our proprietary Media Impact Value™ (MIV®) algorithm, measured and compared the influence of media placements and mentions across various voices to give you an in-depth look at these following five brands.

- Sam Edelman

- Cole Haan

- Loeffler Randall

- Marc Fisher

- Repetto

The infographic above displays the ranking of the five selected footwear brands and the number of placements they had in Q1 2023. These placements factor in social media posts and articles related to specific search queries, as well as consumer interactions with posts, such as tags and comments. It provides a clear picture of some brand’s performance in comparison to others in the industry, allowing you to identify opportunities for growth and maximize your impact.

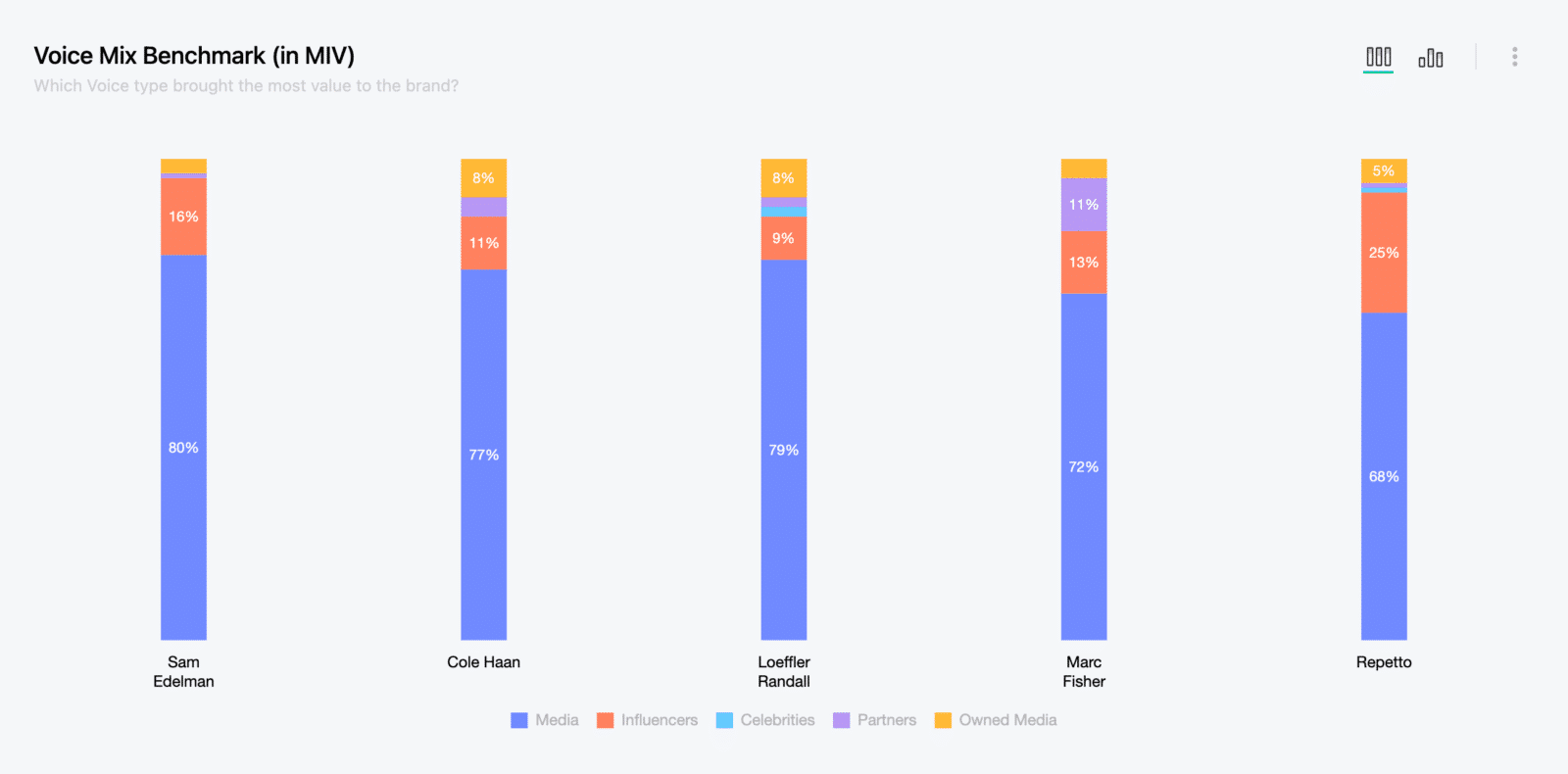

Voice Mix Benchmark for the Footwear Brands

This infographic represents the Voice Mix Benchmark by MIV® for the five premium footwear brands in Q1 2023.

The Voice Mix is a metric that provides the percentage of each of the five Voices that consumers are exposed to Media, Influencers, Celebrities, Partners, and Owned Media. The rate is based on the total MIV®, which each Voice generated for the footwear brands. An awareness of this Voice Mix gives brands a better strategic understanding of the best tactics for themselves or their competitors.

Read on to find out more about the competitive benchmarking and analysis of these five footwear brands.

Sam Edelman

In Q1 2023, Sam Edelman generated $9.5M in Media Impact Value® (MIV®) across 2.2K placements, cementing its position as a well-known name in the footwear industry. However, there was a 27% decrease in the brand’s total MIV® compared to the previous quarter.

In terms of geographic market, the United States proved to be the most lucrative, contributing a significant sum of $8.3M to the brand’s total MIV®. This is mainly due to the presence of significant Influencer placements on Instagram, which helped to generate interest and demand for the brand in this market. It can also be highlighted that the Online channel delivered the highest global MIV® with $6.8M across 1K placements. Instagram followed with $1.1M in MIV®. Nevertheless, this data shouldn’t undermine the importance of prioritizing Instagram in a marketing campaign that aims to effectively tap into Influencer and Celebrity Voices to promote the brand.

The top five key Voices for the brand were essentially from the Media Voice in the US, including from the top: Who What Wear ($3.2M in MIV®), InStyle ($550K in MIV®), Footwear News ($499K in MIV®), and People ($445K in MIV®). The next key Voice was Influencer Grace Byers who generated $299K in MIV® for Sam Edelman across four placements. It’s necessary to point out that while a media outlet such as Who What Wear may generate a higher total MIV® through multiple placements— they accumulated $3.2M across 362 placements— an influencer has the potential to generate a significant amount of MIV® from a single placement. In terms of impact by unique placement, three of Grace Byers Instagram placements came at the very top of the top-performing placements for the brand.

By carefully analyzing Sam Edelman’s MIV® and placement data, the brand can gain valuable insights into its performance in the market, which can inform its marketing and PR initiatives. With data-driven insights, Sam Edelman can develop a more targeted and effective marketing strategy that maximizes the brand’s exposure, engagement, and impact.

Cole Haan

Cole Haan ranked second in our premium footwear analysis, with a significant $3.9M in MIV® generated from 3.7K placements, indicating a considerable market presence and broad consumer coverage. Though they performed slightly less well than the previous quarter, these figures demonstrate Cole Haan’s commitment to delivering exceptional products that resonate with consumers.

Notably, Cole Haan performed exceptionally well in the US market, where it generated a significant $2.5M in MIV®, followed by China with $305K and the UK with $110K. In terms of the brand’s Voice mix, we find that Media is the most prominent Voice, generating approximately $3M in MIV® across 1.2K placements. However, we can’t overlook the fact that Influencers and Owned Media have also played a pivotal role in the brand’s success; the former generating approximately $437K in MIV® across 133 placements and latter also generating an important $294K in MIV®. The Partners and Celebrities Voices, in particular, have proven to not be as valuable for the brand, generating a combined $146K in MIV®.

When it comes to Cole Haan’s Channel mix, Online is the biggest contributor of MIV®, generating an impressive $2.5M, which accounts for 63% of the total MIV® generated for the brand. Among the top-performing social channels, Instagram takes the lead with $506K in MIV®, followed by Facebook with $284K.

Cole Haan’s key voices primarily come from the Media voice, with top media outlets like Who What Wear and Footwear News generating coverage for the brand. However, the top placement for the brand was made by influencer Brittany Sjogren on Instagram. Her post on March 29th garnered $58K in MIV®, making her the top influencer for the footwear brand.

Partnering with influencers and celebrities can boost a brand’s marketing efforts and take its performance to the next level. These individuals have a loyal and engaged following on social media, enabling them to reach a diverse and broad audience. By collaborating with them, footwear brands can tap into their followers and generate substantial brand exposure, leading to more brand recognition.

Loeffler Randall

Third in this footwear ranking, Loeffler Randall generated $3.9M in MIV® across 996 placements. Maintaining their position since the last quarter, the brand’s success can be largely attributed to the brand’s strong presence in the US market, which generated a staggering $3.1M in MIV®.

Like all the other brands in this ranking, Loeffler Randall’s Media Voice has been significantly prominent in the quarter, generating approximately $3.1M in MIV® across 556 placements. The Influencer Voice and the Owned Media Voice only represent 8% each of the total MIV® generated.

What sets Loeffler Randall apart is the impact of its Online presence. The Online Channel accounted for a significant 70% of the Channel mix, contributing $2.7 million in MIV® overall. But that’s not the whole story. The brand’s top three placements across all Voices and Channels were on social media, specifically YouTube and Instagram. This proves the value of these platforms, and demonstrates the potential for brands to connect with their audiences in new and exciting ways.

One example of Loeffler Randall’s success on YouTube is the video shown above created by Influencer Lydia Tomlinson, which generated a remarkable $39.3K in MIV®. So, though the brand still gains the majority of its MIV® from Online Media, it also knows how to leverage the power of social media to drive sales and engagement too.

Marc Fisher

Marc Fisher may have come in fourth place for premium footwear brands in Q1 2023, but they still had an impressive showing, generating $2.9M in MIV® across 702 placements. While this was a 23% decrease from the previous quarter, the brand’s average MIV® per placement actually increased by 8%, demonstrating the impact of each placement overall.

One of the main reasons for Marc Fisher’s success was their Media Voice, which accounted for $2.1M in MIV®. However, it’s important not to overlook the impact of their Influencer Voice, which generated $385K in MIV® across only 126 placements. Of the brand’s top five Key Voices, three were American Media Voices: Who What Wear, Footwear News, and Instyle. Together, these three generated over $1.2M in MIV®, with Who What Wear leading the pack with $822K across 87 placements.

But the top placement for Marc Fisher actually came from a Partner Voice: the Miss Universe Instagram account. This single placement generated an impressive $266K in MIV®. This just goes to show that diversifying your Channel mix is a must if you want to increase your brand’s awareness Online and on Social Media. Tapping more into Instagram can be a powerful strategy, as the platform’s algorithm can maximize your visibility and consumers are particularly loyal to the app.

Repetto

Closing off the premium footwear brands ranking is Repetto, with a noteworthy $1.9M in MIV® across 589 placements in Q1 2023. Likewise to Marc Fisher, while Repetto’s total MIV® shows an 11% decrease from the previous quarter, the brand’s average MIV® per placement actually increased by 2%, highlighting the value of each placement overall.

Interestingly, Repetto’s geographic market plays a significant role in their MIV® generation, with France being the most lucrative market, contributing a predominant $535K to the brand’s total MIV®. Following closely behind is China with $475K.

Analyzing Repetto’s Voice mix, we see that Media is the most prominent voice, generating approximately $1.3M in MIV® across 327 placements. However, it’s important to note that Influencers have also played a pivotal role in the brand’s success, generating approximately $462K in MIV® across 174 placements.

Taking a closer look at Repetto’s Channel mix, we see that the Print Editorial Channel proved to be among the most effective, generating $361K in MIV® (19%). The Online Channel did still come in at the top spot with $761K in MIV®. Instagram fell shortly after Print Editorial, generating $336K in MIV®. Furthermore, Repetto’s top Voices and placements mostly consist of Online Media and Print Editorial placements, highlighting their preference for leveraging online platforms over social media. The brand’s top Voices include Elle in China, Fudge in Japan, and Who What Wear in the US. The top Influencer placement was by Digital Creator @arminarshe on Instagram, who generated $31.4K on her post.

Overall, leveraging Influencers and Celebrities can be an excellent strategy for reaching your target audience, as they have already built a relationship of trust with their followers. By incorporating more of these placements into their strategy, Repetto could generate even more MIV® and further elevate their brand.

How to Benchmark your Premium Footwear Brand

Ultimately, once again, the dip of the market since the pandemic had a significant impact on industry trends, cultural changes and consumer behavior. Taking this into consideration, this insight aims to help your brand gain more awareness about successful marketing strategies to face the challenges which the footwear industry still faces today. It also demonstrates tactics some of the best premium footwear brands use to optimize their brand performance globally.

Do you want to learn more about your brand’s position? How it compares to your competitors? For that, you need a deeper dive into your brand’s performance analytics. Doing so, you can gain valuable insights into your campaigns’ effectiveness and identify areas for improvement.

If this insight has sparked your interest, start benchmarking your footwear brand today by clicking on the link below.