Do you know exactly where your brand is positioned in the market? Are you using all available data to learn what the competition is doing so you can avoid their mistakes, replicate their successes, and stay ahead of industry trends?

In the realm of fashion, luxury, and beauty industries (FLB), competitive benchmarking is a crucial piece of the PR and marketing puzzle. It can be used internally and externally to give you hard data on how your brand is performing, so you can make better strategic decisions and maximize your marketing budget.

In this post, we’ll take you through what competitive benchmarking is, why it’s critical to your PR & marketing success, and how to do it. We’ll also look at some real-world examples. So, let’s jump in.

In this article you’ll learn…

What is competitive benchmarking?

Competitive benchmarking is:

“The process of using relevant metrics to measure where your brand stands against competitors and the market overall.”

This can give you powerful insights into things like:

- Industry trends and best practices

- What’s working for the competition

- Which brands are becoming threats to your position

- Who the key influencers are in your field

- …and more.

As well as benchmarking against external competitors, you can also use competitive benchmarking internally.

For example, an Insights Director at a multinational cosmetic company such as Estée Lauder, with a diverse portfolio of brands, might want to understand how each one performs within the broader company.

How did the recent Clinique campaign stack up against the MAC Cosmetics campaign launched at the beginning of the year? Were there any noticeable trends to be picked up on? Did influencers make a significant impact? Was the securing of print media coverage crucial to their success?

Extracting these internal performance insights will help directors to effectively inform their marketing & PR teams’ strategies, or advise leadership on a potential shift in overall business strategy – based on which brands are performing the best.

Now, you may be wondering: What’s the difference between competitive analysis and competitive benchmarking?

While the two things are similar and may even overlap, competitive benchmarking is more future-focused. It measures how your competitors perform over time so you can find trends in the data, identify best practices, and gain visibility into audience behaviors.

A competitive analysis, meanwhile, is undertaken to:

“assess the strengths and weaknesses of the competition at a given point in time.”

A process especially pertinent during the launch phase of a business. While both of these processes are important, competitive benchmarking allows you to track performance long-term using standardized KPIs.

Why is competitive benchmarking important?

While benchmarking against your own past performance can help you stay on the right trajectory, it leaves out a massive part of the picture. Benchmarking against the competition gives you a clear picture of where you’re positioned and helps you continually optimize your strategic direction.

But there’s a caveat.

For your competitive benchmarking strategy to work at its best, you need consistent metrics. If you’re patching together data from multiple tools and sources, comparing different competitors and time periods becomes difficult and unreliable. (MIV® is an example of a consistent metric—we’ll talk more about that below.)

Once you have reliable data with consistent metrics, competitive benchmarking allows you to:

Spot trends and best practices

If it’s working for the competition, there’s a good chance it will work for you. Using competitive benchmarking data, you can skip the costly trial and error and shortcut to what’s proven to be most effective. For example, if your competitors are having the highest campaign success working with micro-influencers, you can adjust your own influencer marketing strategy accordingly. In the same way, you can see what’s not working for the competition and avoid it.

Strategize

Competitive benchmarking is more than a snapshot of where you stand at any given moment. It provides long-term PR, marketing, and influencer data that can be translated into actionable tactics. It can help you identify opportunities, pinpoint your weaknesses, and determine goals and priorities.

Back up your budget decisions with data

Your gut feelings may be right, but rallying executive support can be difficult without concrete reasoning. An effective competitive benchmarking strategy gives you the hard data you need to validate and back up your spending decisions.

Identify Voices

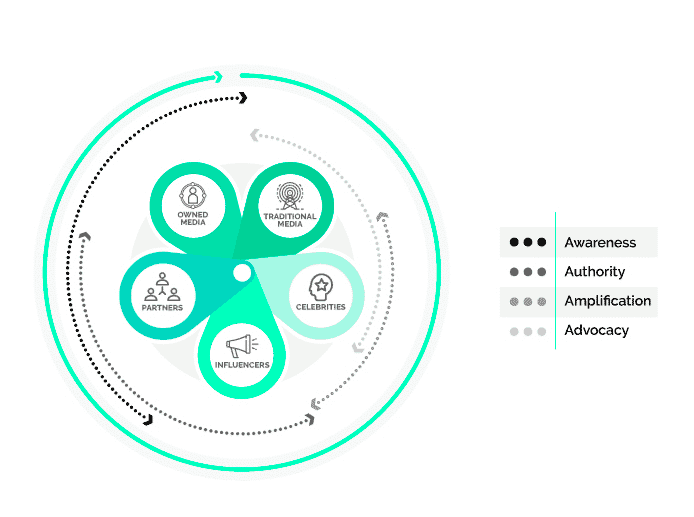

At Launchmetrics, we break down marketing and communication “Voices” into five large groups:

- Influencers

- Celebrities

- Owned Media

- Partners

- Media

Now, imagine if you could find out exactly which mix of Voices offers the maximum strategic effectiveness to your competitors: This would allow you to understand what tactics you are not using that could work for your brand, or what strategies you already have that put you at an advantage.

[If you want to know more about the Voices system to assess the value of your strategy, take a look at Understanding the Voices that influence the buying process.]

Showcase your successes

Competitive benchmarking doesn’t just help your hard work pay off, but it also helps you to prove it. Benchmarking against the competition allows you to measure your impact and share the results with internal stakeholders.

In short, competitive benchmarking doesn’t just give you an edge over your competition; it’s mandatory for any brand that wants to stay relevant and gain market share in an increasingly competitive, social media-driven world.

How do you do a competitive benchmarking analysis?

How you perform your competitive benchmarking will come down to what your goals are, what you want to measure, and what tools you use. To get you started, here are some key things to know, plus some real-world examples.

Choosing which competitors to benchmark

Choosing which competitors to track and benchmark against is a crucial starting point. You need to choose the most relevant competitors in your industry, otherwise, your data will be thrown off.

There are three main types of competitors to consider:

Close competitors

These are your most direct competition—i.e., brands of a similar size and success level. Keeping an eye on what they’re doing helps you stay on the right track and identify opportunities for improvement.

Upcoming competitors

These are smaller brands that may not be a threat to you—yet. But having them on your radar is a good idea. When choosing which ones to track, ask: Which upcoming brands are innovators? Who is generating buzz and rapidly gaining traction in the market? These may have the potential to shake up the industry, and when they do, you’ll want to know about it.

Industry leaders

The bigger brands achieved their success for a reason, so it’s worth looking up to gain insights into how you can do the same. Watching industry leaders will keep you abreast of trends and help you identify best practices.

While close competitors should be your main focus, the best competitive benchmarking strategy will incorporate competitors from all three groups.

Which competitive benchmarking metrics should be tracked?

The next big question is benchmarking metrics. In a nutshell, you want to see where you rank within your industry and find out how your marketing mix is performing against the competitors.

The challenge is how to accurately measure performance in a multichannel environment, where customers flit regularly from physical stores to e-commerce to social shopping and back again, making impact difficult to measure. KPIs like share of voice (SOV), social growth, social reach, and engagement are OK —but none gives a complete picture.

The best solution is to use a concrete indicator, able to standardize the results of the various tactics implemented through the multiplicity of channels and actors.

Media Impact Value (MIV®) is one such metric—a numerical standard in the form of a monetary figure.

This dollar value allows you to easily understand and compare the ROI offered by a post, publication (online or in print), in-house media strategy, or even an entire omnichannel campaign. This figure is calculated using an intelligent algorithm that includes both a quantitative and qualitative assessment.

Having this standardized metric makes it easy to compare your brand against your competitors over time. But on top of that, it also allows you to understand which Voices (as mentioned above, are having the most impact for you versus competitor brands, thus helping you to identify top performers and brand advocates and find the right spending balance.

Competitive benchmarking software tools

One way to conduct your competitive benchmarking analysis is to manually search for and collate data on the competition. Some information is publicly available or calculable—for example, you can track a brand’s social growth or calculate SOV through your media monitoring activities—but other data is more difficult to gather. For example, how can you quantitatively assess the ROI a competitor is gaining from placements in print publications? Or easily calculate how much value a brand is reaping from, say, celebrities versus influencers?

The answer is actually simple: by leveraging technology.

In today’s tech-driven world, the right software tools already exist. They take the grunt work out of the competitive benchmarking process, leaving you free to focus your attention where it matters. A good software tool will not only mine the data for you but also collate and present it in a way that makes it easy to see, at a glance, how your brand is ranking in the industry and how your marketing efforts are working in comparison to your competitors.

You can also benefit from choosing a software tool that’s industry-specific.

Launchmetrics Insights benchmarks hundreds of brands across Fashion, Luxury, and Beauty. Using MIV® as a standardized metric, the Insights dashboard shows the year-on-year evolution of your brand against others. Because MIV provides such a concrete KPI, our Insights tool can also calculate Share of Value (percentage of impact your brand represents compared to your competitors) and more.

If you’re looking to save time and effort in your competitive benchmarking, having the best tools is crucial.

Competitive benchmarking examples

To demonstrate competitive benchmarking in action, I think it makes sense to look at a couple of different examples.

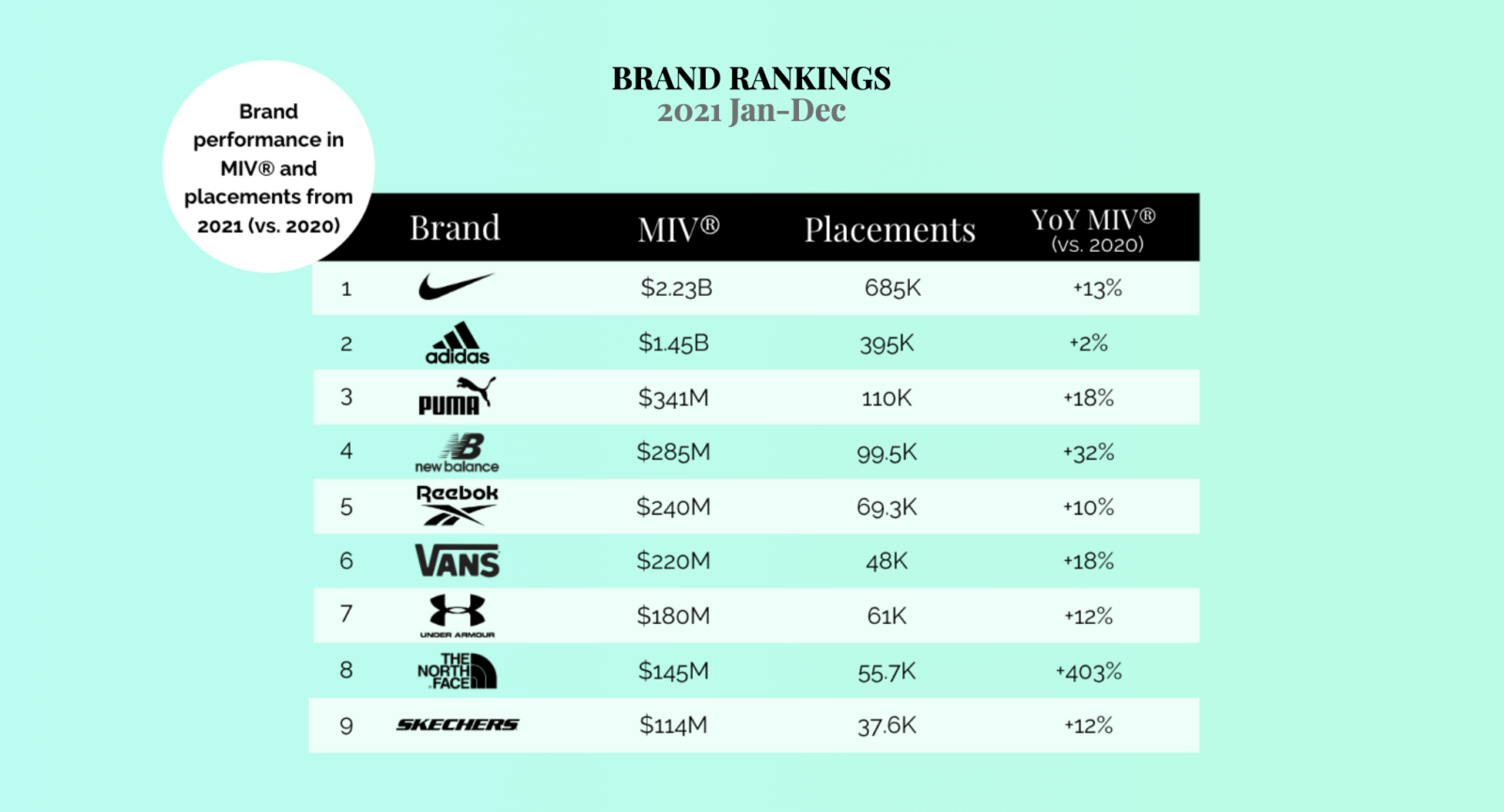

Athleisure Market Report

The first one is an Athleisure Market Report we put together in the summer of 2022. We wanted to see the impact the COVID pandemic had had on the industry from 2020 to 20221, how brands stacked up against each other, and most importantly, which strategies were having the greatest impact.

After conducting a competitive benchmark analysis of 9 selected athleisure brands using Launchmetrics Insights, we discovered the following:

It was no surprise to see Nike and Adidas with the highest MIV® figures, considering their size, market share, and marketing and PR budgets.

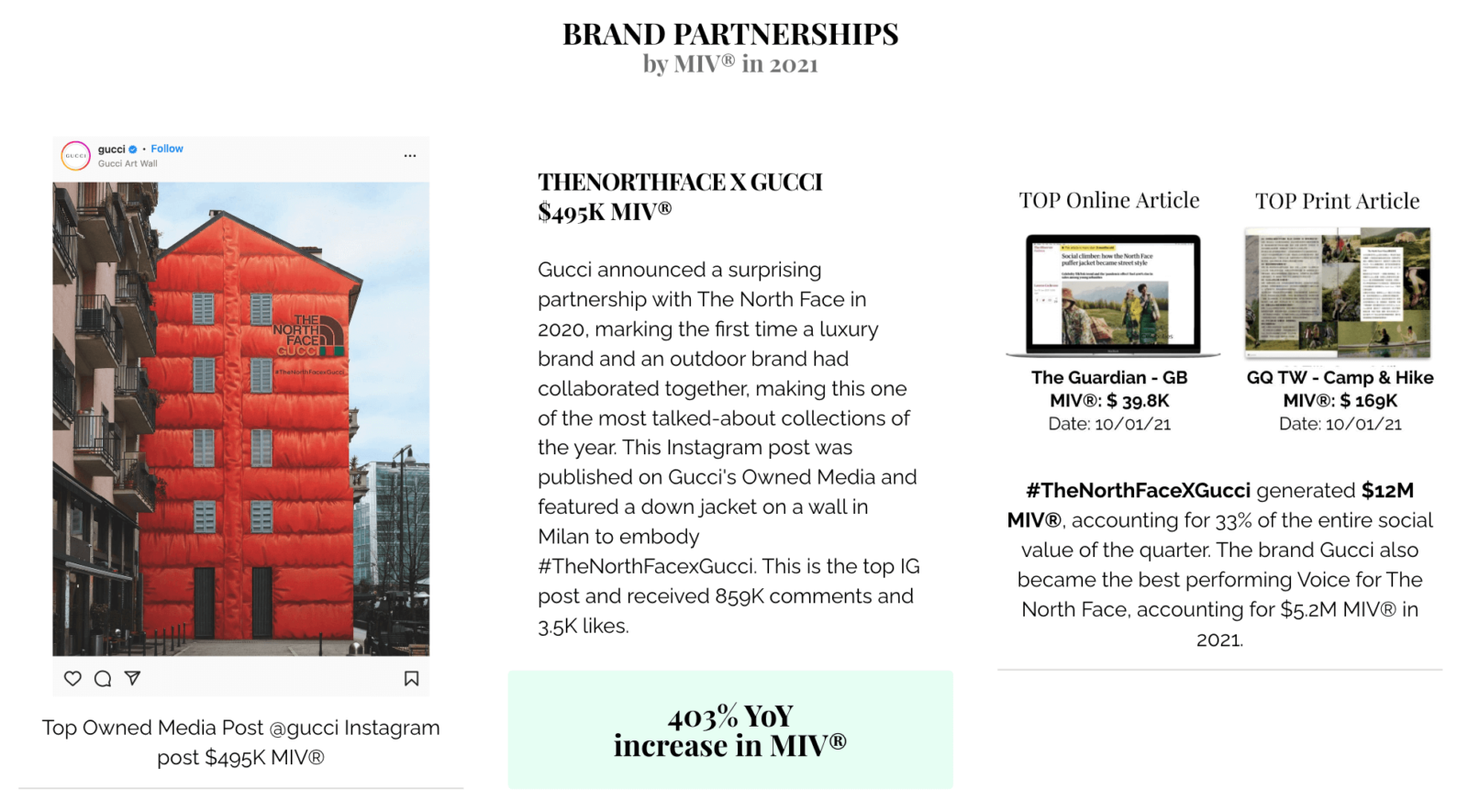

However, one interesting takeaway pulled from our competitive benchmark analysis was the 403% YoY MIV® increase The North Face experienced from 2020 to 2021. It’s significantly higher than any of the other benchmarked brands.

So, why was this? What strategies and tactics did the outwear brand employ to boost its MIV®?

After digging a little deeper it turns out they successfully leveraged brand partnerships:

The North Face’s collaboration with Gucci marked the first time a luxury and outdoor brand had combined to such great success.

This unique tactic (at the time) is something we’re seeing replicated into 2022, with cross-brand partnerships such as Nike and Louis Vuitton proving particularly successful.

If you’d like to view the full Athleisure Market Report, click below.

Beauty Marketing Report

Another good example of a competitive benchmark analysis is a report we recently put together from the beauty industry.

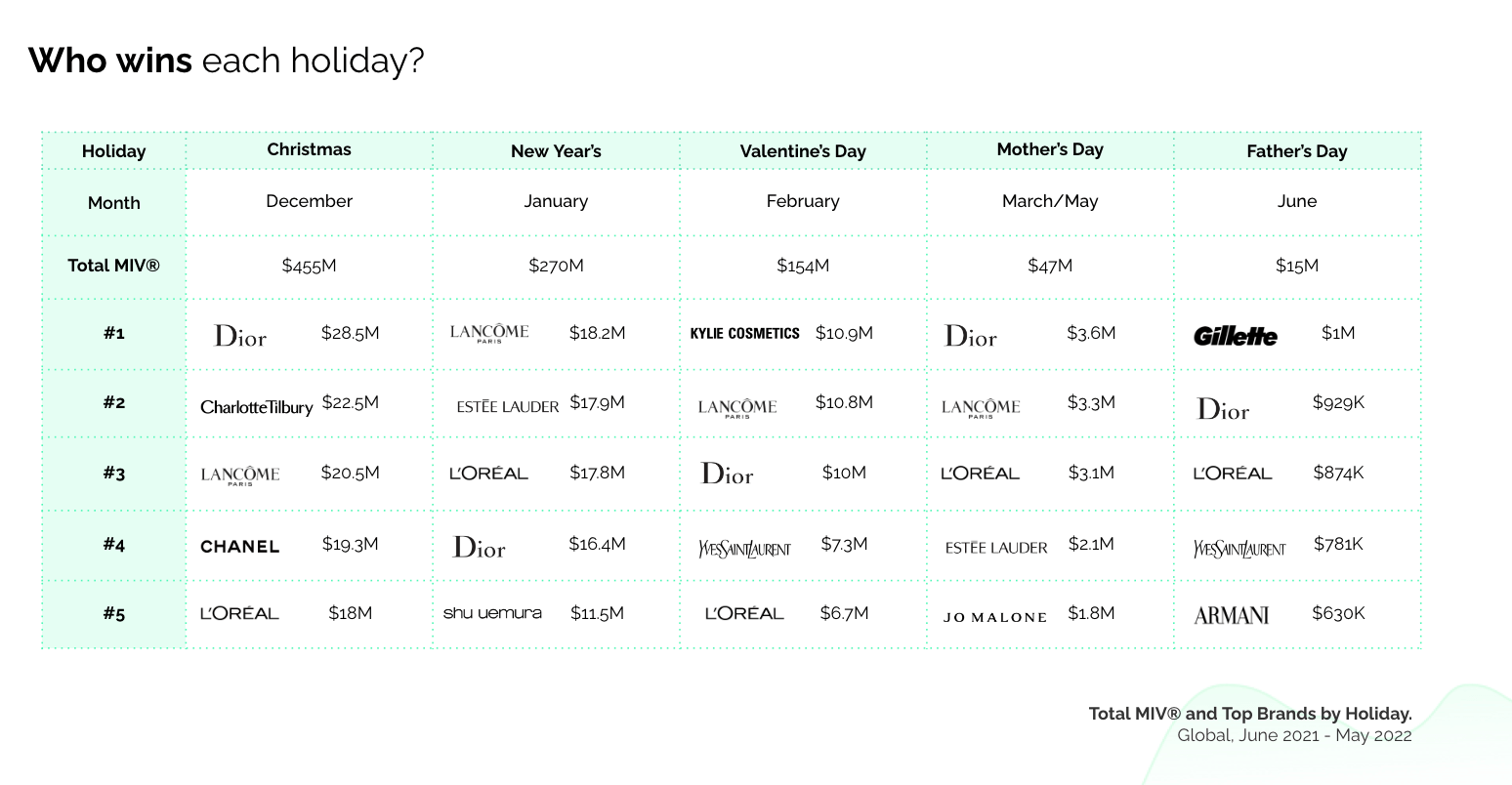

We wanted to look at some of the most important cultural, regional, and eCommerce holidays on the global calendar and see how brands capitalized on key celebratory days to generate buzz and drive MIV®.

Again, using Launchmetrics Insights we were able to benchmark the performance of a select group of beauty brands over a series of 5 major celebratory days in the calendar:

As you can see, this analysis provides a great overview of how brands performed relative to one another. However, to obtain maximum value from the benchmarking we have to dig deeper.

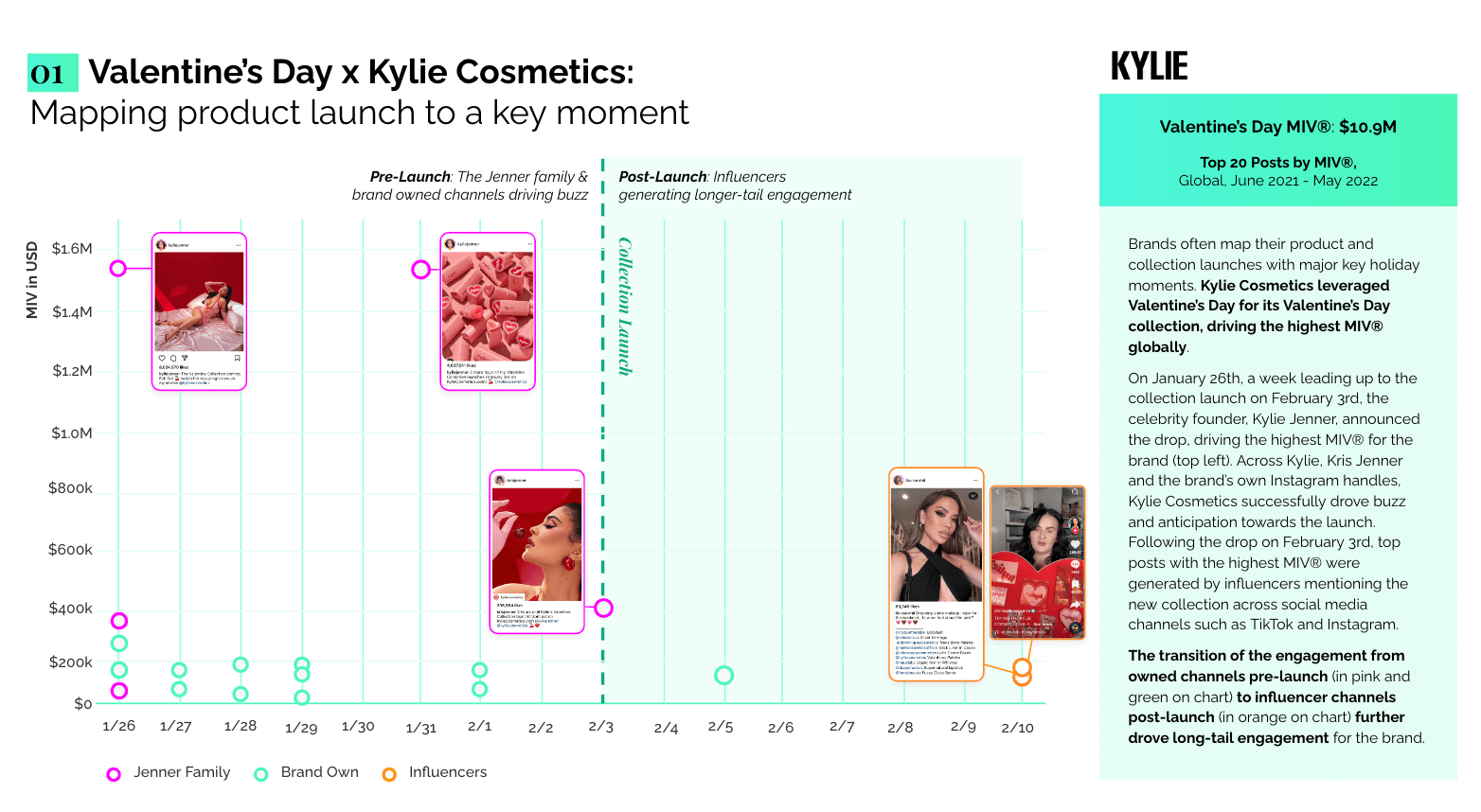

Let’s look at Valentine’s Day, for example. Kylie Cosmetics was the highest-performing brand with a total MIV® of $10.9m. But why? Were there any particular strategies or tactics that the brand used? What can we take away from this analysis to perhaps integrate into our own PR and marketing campaigns?

On January 26th, a week leading up to the collection launch on February 3rd, the celebrity founder, Kylie Jenner, announced the drop, driving the highest MIV® for the brand.

Across Kylie, Kris Jenner and the brand’s own Instagram handle, Kylie Cosmetics successfully drove buzz and anticipation toward the launch. Following the drop on February 3rd, top posts with the highest MIV® were generated by influencers mentioning the new collection across social media channels such as TikTok and Instagram.

The transition of the engagement from owned channels pre-launch (in pink and green on the chart) to influencer channels post-launch (in orange on the chart) further drove long-tail engagement for the brand.

If you’d like to view the full Beauty Marketing Report, click below.

Conclusion

The importance of competitive benchmarking should not be understated. After all, your business doesn’t exist in a vacuum—it exists relative to your competitors. You want to retain your audience plus attract the interest of new consumers who are less loyal to brands and base their choices on external recommendations. And to do that, you need to understand the competitive scenario you’re in and allocate your marketing budget accordingly.

As we’ve discussed above, to make the process as easy and effective as possible, the wisest move you can make is to leverage the right tools. Doing this makes it easy to track not just where your brand is positioned but why. So, you can learn from your competitors, replicate their most successful tactics, and ultimately, increase your position in the market.

How do you go about competitive benchmarking? And what could you do better?